The Walt Disney Company releases their Quarterly Earnings Report 4 times a year, and each time, the report is accompanied by an earnings call.

Today is Disney’s Quarter Four Earnings Call, reporting on the performance of the company it its fourth fiscal quarter of 2021, which ended recently. We’ve also gotten some information about the full fiscal year of 2021. Now, thanks to the report that has been released, we’ve got some updates about just how Disney is doing financially and more. Check out the information you need to know here.

Overall Financial News

In terms of overall financials, Disney has shared that “Diluted earnings per share (EPS) from continuing operations for the quarter was income of $0.09 compared to a loss of $0.39 in the prior-year quarter.”

Overall, the total revenues for fiscal year 2021 were $67,418,000, as opposed to $65,2388,000 from the previous fiscal year. That’s a change of just 3%.

Disney noted that the world has been (and continues to be) impacted by COVID-19, and that the pandemic has impacted the company in a variety of ways, especially at the theme parks.

Disney also noted that for a period of time cruise ship sailings and guided tours were suspended, they have delayed (or sometimes shortened or canceled) theatrical releases, and stage play performances were also previously suspended.

Disney also shared that they were impacted by limitations in capacity, the delay of some live sports programming, and the suspension of some film and TV production.

Disney expects that additional costs will need to be incurred when it comes to safety measures and government requirements. Specifically, they noted that “We have and will continue to incur costs to address government regulations and implement safety measures for our employees, guests and talent…These costs totaled approximately $1 billion in fiscal 2021. Some of these costs have been capitalized and will be amortized over future periods.”

When it comes to the parks, Disney noted that this is the segment that has been most impacted by COVID-19. According to Disney, results improved in the second half of fiscal year 2021 compared to the second half of fiscal year 2020, but they “continue to be impacted by reduced operating capacities.”

When it comes to media and entertainment, Disney noted that the segment overall had “higher advertising revenue from the return of live sporting events,” though that was “more than offset by higher sports programming costs.” They shared that the film and TV distribution was “impacted by revenue lost from the deferral or cancellation of significant film releases, partially offset by costs avoided due to a reduction in film cost amortization, marketing and distribution costs.”

The chart above summarizes the segment revenue and operating income for those divisions. You can see the comparisons in terms of how the segments did in 2021 versus 2020, both for the quarter and the entire year. It appears the change for Media and Entertainment (in terms of revenue) was a positive change of 9% for the quarter when compared to the prior year quarter, while the change for parks and experiences (in terms of revenue) was 99% compared to the prior year quarter. The change percentages look a bit different, however, when looking at the entire year.

Let’s take a closer look at the various segments that make up the Disney company and how they did.

Media

In terms of media and entertainment distribution, Disney has reported $16,319,000 in revenues for direct-to-consumer for the fiscal year, compared to $10,552,000 during the prior fiscal year. That’s a change of 55%.

There was also a change of 2% when it comes to revenues for linear networks.

In terms of operating income, direct-to-consumer showed a loss of $1,679,000, which is less than what was reported in the previous fiscal year. But, when you look at just this quarter in comparison to the prior year quarter, direct-t0-consumer showed a LARGER loss.

The operating income at linear networks appears to have decreased in fiscal year 2021 as compared to 2020.

Disney+ News

In terms of direct-to-consumer news, Disney has shared that “Direct-to-Consumer revenues [across all of their platforms] for the quarter increased 38% to $4.6 billion and operating loss increased from $0.4 billion to $0.6 billion.”

Disney explained that the higher loss for the quarter at “Disney+ was due to higher programming and production, marketing and technology costs, partially offset by increases in subscription and Premier Access revenues.” During the quarter, Premier Access revenues were generated by 2 specific movies — Black Widow and Jungle Cruise.

Here’s a full look at the subscription numbers. Disney+ now shows a total number of 118.1 million subscribers!

Note, however, that the average monthly revenue per paid subscriber actually went DOWN for fiscal year 2021. Disney notes that this is “due to a higher mix of Disney+ Hotstar subscribers in the current quarter compared to the prior-year quarter.”

Click here for our updates about Disney+.

Disney Parks, Experiences, and Products

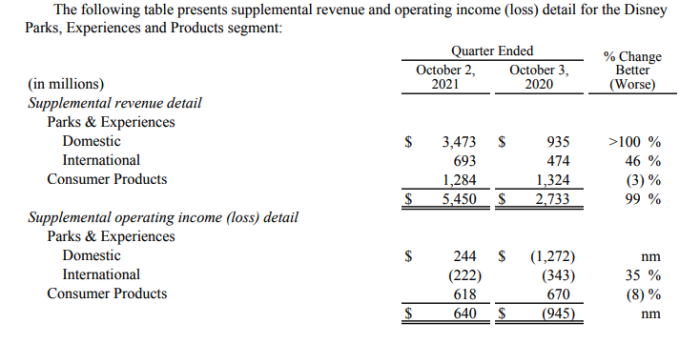

When it comes to the parks, revenues for the quarter INCREASED in this past quarter, compared to the prior year quarter. Specifically, “Disney Parks, Experiences and Products revenues for the quarter increased to $5.5 billion compared to $2.7 billion in the prior-year quarter.” Compared to the prior year quarter, the change was 99%.

In addition, “Segment operating results increased $1.6 billion to income of $640 million.”

Disney notes that the growth in revenue and operating income was “due to the reopening of our parks and resorts, which were open for the entire quarter this year.”

To read more about what was shared during the Q4 earnings call, check out our links below:

- A BIG number of Disneyland Magic Key sales were to NEW passholders — click here to see more

- How many guests are buying Disney Genie+? Disney has revealed some numbers

- Park attendance and guest spending has increased in Disney’s parks

- Here’s when Disney expects to recover from the loss of international visitors

- Disney+ announces updated timelines for 3 BIG titles

- Disney is considering reducing food portion sizes to cut costs

You can also click here to see the Q4 fiscal report. Stay tuned to DFB for more Disney info!

Click here to learn more about when the next big Disney announcements will happen!

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

What big news is the most surprising to you?! Let us know in the comments!

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

We guests are paying the load while at the same time being priced out. Not good.

While comparing to prior year is the norm and it shows recovery, comparisons to 2019 would be more effective to really see performance. 2021 vs 2019 would look look tragic, just not quite a bad as 2020.

Domestic parks had very little profit and was offset by losses at international parks. The only real profit in this segment was in consumer products. This segment is only 25% of Disney business. Your headline may be correct but revenue is no indication of profit. Most people don’t understand business Financials. Profits/margins are still very small at the parks as compared to pre-pandemic. People are very emotional about the cost of going to the parks and believe Disney is making BILLIONS in profit there which isn’t currently true.

When it comes to incomes , I most Americans, I haven’t seen a raise in almost ten years everyone is just getting by . So now instead of spending our money at Disney Parks which our only please of mind for family across the world we have to prolong until we can afford one.

Disney is not helping by driving prices so high. But are the top Ex’s taking any cuts like the rest of us.