Is 2022 going to be a BIG year for Disney? It seems like the answer to that is “yes.”

We already know about some of the important things taking place this year including D23 Expo, the opening of the Star Wars Hotel, the opening of the Guardians of the Galaxy Coaster, and more. But things are also looking interesting from a financial perspective. The Walt Disney Company recently released its latest earnings report, giving us an inside peek at the Company’s financial situation. Just how are the parks, Disney+, and more doing? Here’s what we’re seeing!

Today, Disney released its Earnings Report for the First Quarter of Fiscal Year 2022. That quarter started back in the fall of 2021 and ended on January 1st, 2022.

Overall Financial Results

For this past quarter, Disney has announced that its “diluted earnings per share (EPS) from continuing operations for the quarter increased to $0.63 from $0.02 in the prior-year quarter.” Excluding certain things, the “diluted EPS for the quarter increased to $1.06 from $0.32 in the prior-year quarter.”

As CNBC shares, this exceeded some expectations. Earnings per share were at $1.06 adj. versus the 63 cents that was expected by some analysts. Revenue was at $21.82 billion versus the $20.91 billion that was expected by some analysts.

According to current Disney CEO, Bob Chapek, Disney has had a strong start to fiscal year 2022. Chapek noted, “We’ve had a very strong start to the fiscal year, with a significant rise in earnings per share, record revenue and operating income at our domestic parks and resorts, the launch of a new franchise with Encanto, and a significant increase in total subscriptions across our streaming portfolio to 196.4 million, including 11.8 million Disney+ subscribers added in the first quarter.”

Chapek noted that the Company’s performance coupled with its assets gives him “great confidence we will continue to define entertainment for the next 100 years.”

Here’s an overview of the company’s financial standing for the quarter.

Let’s break down some of the BIG areas of the company that have seen massive growth recently and just how other divisions are doing.

Impact of COVID-19

In terms of the Disney parks and beyond, the report notes that COVID-19 has impacted things since 2020 and that COVID-19 continues to impact the world. The report shares that in 2020 and 2021, various theatrical releases were canceled, shortened, or delayed, and there were delays in live sports and more.

In fiscal year 2022, however, Disney’s domestic theme parks and experiences have been “generally operating without significant mandatory COVID-19-related capacity restrictions.” BUT Disney notes that they “continue to manage capacity to address ongoing COVID-19 considerations with respect to guest and cast health and safety.”

Click here to see our full post about Disney’s comments on theme park capacity!

Disney also notes that some of their international operations might be impacted due to mandatory COVID-19-related travel restrictions or capacity rules.

In terms of media, they noted that there have been some disruptions in production, but have generally been able to release films theatrically. Disney also shares that costs will continue to be incurred to address government regulations and for the safety of their Cast Members, guests, and more.

Disney Parks, Experiences, and Products Updates

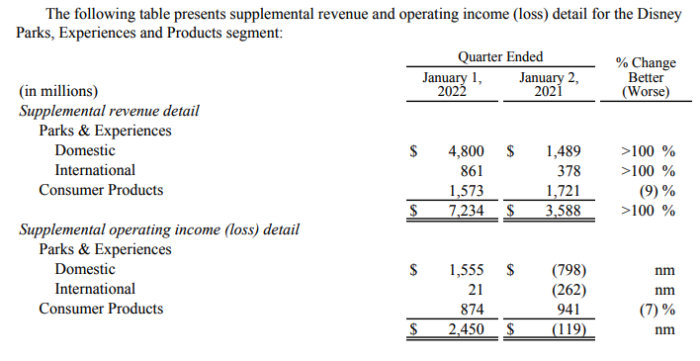

When it comes to the parks, Disney has seen some tremendous growth in this past quarter as compared to the same quarter during the previous year.

According to Bob Chapek, the parks achieved “all-time revenue and operating income records” during the past quarter. In fact, Chapek shared that it was the 2nd best quarter of all time.

During the 1st quarter of fiscal year 2022, the revenues for Disney Parks, Experiences, and Products increased to $7.2 BILLION compared to just $3.6 billion in the prior-year quarter (meaning the same quarter of the previous year). That’s essentially DOUBLE the revenue in terms of a comparison!

When it comes to supplemental operating income, the division reported $2.5 billion for this past quarter compared to a LOSS of $100 million during the same period in the prior year.

Consumer products, however, did see a revenue loss of around 9%. As CNBC points out, this loss does follow the closure of a large number of Disney stores in 2021.

This makes a lot of sense given how different things were during this prior quarter as compared to the previous year. As Disney notes, its domestic parks and resorts were open for the entire current quarter, whereas Disneyland was closed for all of the prior-year quarter and Disney World was operating at a reduced capacity because of COVID-19 rules.

Similarly, Disneyland Paris was open for the entire current quarter, while it was only open for a few days (26) in the prior-year quarter. Hong Kong Disneyland (though currently closed) was open for more days in this past quarter as compared to the prior-year quarter.

On the domestic side, Disney shared that operating income growth was due to “higher volumes and, to a lesser extent, increased guest spending, partially offset by higher costs.” The higher volumes were due to “increases in attendance, occupied room nights and cruise ship sailings.”

In terms of guest spending, Disney’s report notes that the growth there was due to “an increase in average per capita ticket revenue, higher average daily hotel room rates and an increase in food, beverage and merchandise spending.” Disney even specifically cited Disney Genie+ and Lightning Lanes as some of the reasons for the increased in per capita ticket revenue for guests.

Click here to see what Disney has said in terms of how many guest are actually buying Genie+

Disney+ Subscriber Numbers

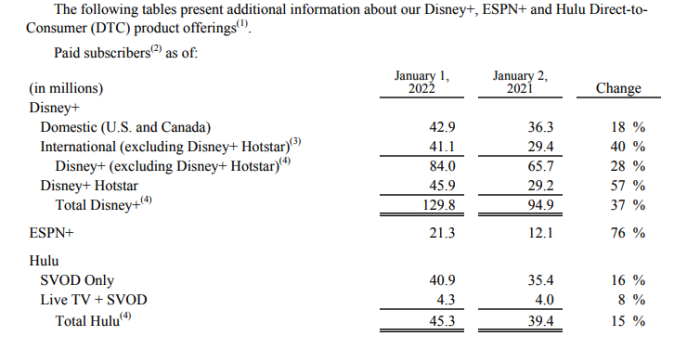

In terms of Disney+ subscribers, Disney saw a jump there too. As of October 2nd, 2021, Disney+ had 118.1 million subscribers. Today Disney shared that as of January 1, 2022, Disney+ had a total of 129.8 million subscribers (this includes Disney+ Hotstar). That is an increase of 37% compared to the prior-year quarter.

CNBC notes that these numbers exceeded expectations. Some analysts expected the subscriber number would be around 125.75 million.

In terms of overall Direct-to-Consumer revenues for the quarter, Disney noted that it “increased 34% to $4.7 billion and operating loss increased 27% to $0.6 billion.

Click here to see our full post on the latest Disney+ subscriber numbers!

We’ll continue to update this post with more information as we find it in the earnings report or earnings call. Check back for updates!

Of course, only time will tell how things will continue to go for the Disney company. We’ll be keeping an eye out for more updates and let you know when we have them.

Disney’s Newest Cruise Ship Has Been Delayed — Learn More Here

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

WE KNOW DISNEY.

YOU CAN, TOO.

Oh boy, planning a Disney trip can be quite the adventure, and we totally get it! But fear not, dear friends, we compiled EVERYTHING you need (and the things to avoid!) to plan the ULTIMATE Disney vacation.

Whether you're a rookie or a seasoned pro, our insider tips and tricks will have you exploring the parks like never before. So come along with us, and get planning your most magical vacation ever!

What’s your biggest takeaway from the Disney earnings call and report? Let us know what you think in the comments.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Let’s see…

Price gouging = higher profits

Got it!

Yeah that tends to happen when you fire a giant chunk of your staff, pay poor wages and benefits, and then charge wildly higher prices for everything.

Just another reason I never want to go to Disney World anymore. Raise prices so they can raise their profits.

It’s not surprising that Disney is making more money, since they are now charging for everything that used to be free.