You’ve heard it on the news, you’ve heard it on the radio, you’ve heard it in a podcast, you’ve read about it on Twitter, and now it’s in a Disney Food Blog article?! YES…we don’t talk about Bruno (well, sometimes we do) but we’ve GOT to talk about INFLATION.

A lot of things could impact your trip to Disney World in 2022 — weather concerns, COVID-19 worries, Park Pass limitations, budget constraints, and more. But inflation could also seriously impact your trip. “Inflation” is a word you might hear thrown around in the news a LOT right now. What is it? What’s going on with inflation right now? And how could you feel the impacts of it during your trip to the Most Magical Place on Earth? We’re breaking down everything we know right here.

What Is Inflation and Why Does it Change?

As we mentioned above, “inflation” is something a LOT of news sources are talking about right now. But what does it really mean? According to the New York Times, inflation is defined as a “loss of purchasing power over time.” Essentially it means that your money won’t get you as much or go as far tomorrow as it might have today.

The way that inflation is expressed (typically) is the “annual change in prices for a basket of goods and services.” In the United States, there are 2 big “inflation gauges.” The one we’ll mostly be referring to in this article is the Consumer Price Index or C.P.I. The New York Times notes that the C.P.I. “measures the cost of things urban consumers buy out of pocket.”

Who works on inflation-related issues in the U.S.? Well, the Federal Reserve (which is America’s central bank) is in charge of “keeping prices from increasing too rapidly.” The New York Times shares that a little bit of consumer price inflation is generally looked at as a good thing. If labor and commodities start to cost businesses more, then a little inflation can actually give companies the chance to adjust (and charge higher prices) without being forced to go out of business. 💰

Why does the level of inflation change? The New York Times notes that inflation can change for a variety of different reasons. High levels of inflation can be due to an economic situation where people have “a lot of surplus cash or are using a lot of credit to buy things.” If people are quickly buying lots of things up, then businesses might need to raise their prices because they might not have enough supply for everyone to continue buying the items at that fast rate. Or businesses might just decide to raise their prices because they can. In other words, they realize that people will pay more for those items and so they can raise prices and increase profits without losing those customers.

Higher levels of inflation can also come from other things though. For example, supply chain issues (something we’ve heard a lot about lately — more on that in a second) can impact inflation. If supply chain issues cause certain goods to be in shorter supply than usual, prices might get pushed up.

Click here to see how a supply issue could impact your Disney World shopping.

What’s Happening With Inflation Right Now?

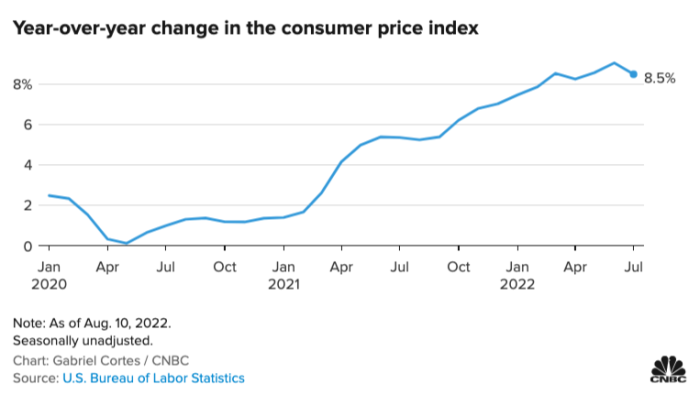

As FOX 6 Now reports, inflation rates went WAY up in 2021, and that has only continued in 2022.

According to CNBC, as of June 2022, the CPI is up 9.1% compared to a year ago. This marks the “fastest pace for inflation going back to November 1981.” Excluding those volatile food and energy prices, “core CPI” increased 5.9%. Core inflation seems to have peaked at 6.5% back in March. But when looking at those numbers combined with the ones that look at things on a month-to-month basis, it seems to counter the story that inflation is peaking.

UPDATE: CNBC reported that the CPI rose 8.5% in July 2022 compared to a year ago (a 0.6% drop from the June 2022 peak). This increase was below many expectations for the increase, which can largely be attributed to falling gas prices. In July, “energy prices broadly declined 4.6% and gasoline fell 7.7%.” In addition, the core CPI rose 5.9% annually and 0.3% monthly, while experts had predicted it would rise 6.1% annually and 0.5% monthly. Aneta Markowska (a chief economist at Jefferies) said, “Things are moving in the right direction. This is the most encouraging report we’ve had in quite some time.”

UPDATE: The Orlando Sentinel reported that U.S. inflation slowed for a second straight month in August on a sharp fall in gas prices. However, most other items became MORE expensive in August, which shows that inflation remains a heavy burden for American households. Consumer prices went up 8.3% in August compared to 2021, but this was down from the 8.5% jump in July and the four-decade high of 9.1% in June.

However, core prices jumped 0.6% from July to August, which is up from the 0.3% of the previous month. Rents, medical care services, and new cars all increased in price in August.

Groceries continue to rise rapidly, jumping 0.7% from July to August. In the past year, they have soared 13.5% — the biggest 12-month increase since 1979.

The Orlando Sentinel, however, reports that some experts are holding out hope that inflation might be getting close to its peak, at least in the short term. Why? Well, because gas prices have fallen a bit and shipping costs have started to get lower too. But many are still seeing the impact of inflation, especially those looking for houses where there are some large inflation rates, higher mortgage rates, and high home prices.

Recently, President Biden “declared inflation ‘the No. 1 problem facing families today’ and [his] ‘top domestic priority.'”

According to Biden, supply chain issues and Russia’s invasion of Ukraine are some of the things that have “ignited” inflation. FOX 35 News points to a few factors that could indicate that inflation has peaked including some falling gas prices (though these can vary), expectations around used car sales having dropped, and some supply chain issues having been resolved when it comes to automakers.

What has inflation impacted? Well, the real question is probably what it hasn’t impacted. Click Orlando News notes that prices have risen for cars, food, furniture, and gas. According to CNN, the Personal Consumption Expenditures price index — which measures the change in the prices of goods and services purchased by consumers — increased by 6.8% in June over same period last year, according to recent data from the Bureau of Economic Analysis.

Here are some quick numbers and facts:

-

- From CNBC (as of June 2022): Gasoline prices have increased just shy of 60% for the 12-month period; electricity costs are up 13.7% compared to a year ago, and “new and used vehicle prices posted respective monthly gains of 0.7% and 1.6%”

With inflation rising to high levels, small businesses (and large businesses too!) are increasing their prices. FOX 6 Now cited a study done by business.org which showed that 82% of small businesses had to increase their prices for their products or services as a result of inflation.

FOX 6 Now shared that about 92% of small businesses in that business.org study reported that they’ve seen the cost of supplies or services increase since the COVID-19 pandemic started.

Supply chain issues are also impacting the situation. About 64% of small businesses in the study reported “an inability to acquire products or perform services. Another 56% said they have been unable to meet customer demand and 43% are being forced to change their products altogether.”

According to Click Orlando News, shortages have also impacted things like used car prices. Used car prices have increased more than 37% over the past year alone because of supply chain issues with the semiconductors needed for cars.

In many cases, businesses have raised prices to pass on these higher labor and food costs to their customers. Click Orlando News shares that Darden Restaurants has increased prices by 2% and expects to increase them by another 4% over the next 6 months.

CNBC shared that Kellogg might raise prices (again) in 2022 due to inflation concerns. Kellogg CEO Steve Cahillane said that customers have been willing to pay for their products, even though some price hikes were made last year. Cahillane shared, “We don’t want prices to get too high, but we’re in an environment where it’s broad-based, it’s across everything, but we’ve been able to cover it. Our pricing performance has been very solid.”

Prices at the wholesale level have also gone up. According to the Orlando Sentinel, “prices at the wholesale level surged by a record 9.7% for all of 2021, setting an annual record and providing further evidence that inflation is still present at all levels of the U.S. economy.” The Labor Department did report, however, that it did slow on a monthly basis in December compared to November. Still, the 12-month increase in wholesale inflation was the “fastest annual jump on record.” In 2020 the increase was 0.8% and it was 1.4% in 2019.

While the wholesale price gains slowed down in December a bit, some economists have warned that there’s still a ways to go. Continued supply chain issues are expected to “pin producer prices near record levels” especially given the impact of the Omicron variant.

The Washington Post notes that these high inflation levels come with a big risk. According to Fed Chair Jerome H. Powell, quoted by The Washington Post, “if these high levels of inflation become too entrenched in the economy or people’s thinking, that will lead to much tighter monetary policy from us, and that could lead to a recession and that would be bad for workers.”

As FOX 35 Orlando notes, the U.S. federal government has recently raised its “benchmark short-term rate by a half-point,” marking the steepest increase in interest rates in two decades.

The Washington Post notes that everything from hotels and airline costs to shelter, used vehicles and furnishings, apparel, and other costs have gone up.

UPDATE: CNBC reported in July 2022 that prices are beginning to fall for gasoline, apparel, used cars, and airline tickets. While some are hopeful that June 2022 marked the peak in inflation, others warn that we can’t be sure of a steady decline. Greg McBride (a chief financial analyst at Bankrate.com) told CNBC, “To really feel like we’ve hit a peak, we need to see a sustained pullback in a broad range of categories, and we’re not seeing that: Some of the sharpest increases in categories like necessities continue, with food prices up at the fastest pace in 43 years.” In addition, home prices are still on the rise, and rental properties are increasing prices as well.

Subsequently, the Orlando Sentinel reported that inflation may be easing, as core inflation rose 4.6% in July, compared to the 4.8% rise in June. Furthermore, consumer prices rose 6.3% in July, after June saw an increase of 6.8%. Energy prices also dropped in July after significant increases in June. This could suggest that inflation has reached its peak, and we may be seeing lower prices moving forward.

What are the expectations for the future? Well, CNBC notes that Andrew Hunter, a senior U.S. economist at Capital Economics, has said that they expect a partial easing of supply chain issues and shortages to push core inflation lower this year, but the latest numbers suggest “it will remain well above the Fed’s target for some time.”

We’ve shared several posts already about how supply chain issues and other issues have impacted various items including cream cheese, the price of beef, lightsabers, and more. But just how could inflation specifically impact your Disney trip this year?

Click here to see more about the price increases expected for popular snacks

How Could This Impact Your Disney Trip?

Disney Is Aware of the Issue

Disney is well aware of the inflation concerns and preparing to (or potentially has already started to) take action. During the 2021 Q4 earnings call (a transcript of which you can find here) one analyst specifically asked how Disney plans to mitigate these high inflation rates. Christine McCarthy, Disney’s Chief Financial Officer, said that this question is one that is on the “minds of every CFO and every senior management team of companies out there.”

According to McCarthy, the pressures of inflation are something that they’re looking at and trying to see how they’ll address. She also noted that it is an issue they’ve experienced in some parts of the business already. In the parks, McCarthy said they’ve already seen the impact of inflation when it comes to hourly wages. Specifically, she said they’ve seen it through “contract renegotiations and [their] commitment to paying [their] park workers well.” But inflation is something McCarthy said they’ve also seen on the cost of goods side.

According to CNBC, some of Disney’s inflation problems are a bit complicated. At the moment, CNBC notes that it’s unclear how much of the inflation issue will be “sticky” and could be around for a while — like the wage inflation, vs. how much will be “transitory.” Transitory inflation issues could pass within a few quarters, giving management an easier time at hitting their financial targets, while wage inflation could cause more impacts.

Click here to see more about how air travel costs are predicted to INCREASE

Ticket Prices

So, just how could inflation impact your 2022 trip? For starters, it could potentially impact ticket prices. The Wall Street Journal notes that Disney has typically been able to outpace inflation when it comes to ticket prices. When Disney first started charging a single admission fee in 1981 (no more individual A-E tickets for the rides) the price was $9.50—$8.89 excluding the 4% sales tax, according to our friends over at AllEars.net.

In 2021-2022, a single-day ticket starts at $109 (without taxes). The Wall Street Journal notes that the increase there is a “compound growth rate of 6.39%.” In the meantime, the C.P.I. “increased by 2.76% a year over that same period.” In layman’s terms, over the past several years Disney’s ticket prices have increased…a lot.

The Wall Street Journal notes that for about 40 years the price of Disney World tickets has gone up “2.3 times as fast as the C.P.I.” Why have tickets been increasing so much and been able to outpace inflation to such a high degree? According to the Wall Street Journal, it’s likely not due (or at least not just due) to increases in Cast Member wages or the cost of ride-building supplies.

The Wall Street Journal opines that prices have gone up to such a degree because of all of the new and engaging rides, expanded areas, and other new features Disney has added to the parks. They note that prices have gone up so much “because consumers value its experience more than the average market-basket good and are willing to pay much more for it relative to other offerings.”

Basically, as Disney adds new immersive, exciting offerings that it feels add value to the parks and consumers will pay more for, prices increase (and generally they’ve increased at levels beyond the increase in inflation).

Indeed, Disney CEO Bob Chapek has indicated that prices are going up in the parks due to DEMAND.

In an interview with CNBC, Chapek said, “This is a supply and demand business. Unfortunately, unlike say Disney+, we have a fixed supply and we commit to our guests to give them the absolute best Disney experience no matter when they come. And, you know, one of the ways that we do that is by taking those guests that want to have a more bespoke, more personalized, more customized, more expensive day and using that essentially to keep the lower prices on again, the second Tuesday in September. And so, it’s really demand that drives it.”

CNBC notes that these high margins for ticket price increases versus inflation should serve Disney well during this time (giving them a bit of a cushion to absorb some higher costs), but that doesn’t mean that the pressures of inflation will necessarily be totally eased.

Disney’s plans for the future seem to include MORE attractions and things focused on growing this “experience economy,” as The Wall Street Journal calls it. Immersive experiences like the Space 220 restaurant, the new Star Wars hotel, the TRON coaster, the Guardians of the Galaxy coaster, and more have already opened or are on their way to the parks.

If Disney feels like guests will be willing to pay more for these offerings and that these add more value to the parks, then ticket prices will likely continue to increase, potentially past inflation rates. That’s not so much an impact of inflation but a possibility that Disney will continue to increase ticket prices at levels that are above inflation levels.

Inflation alone, however, could result in some ticket price increases in the same way that we’ve seen higher costs passed down to consumers at other small and large businesses. But things can change.

It’s also worth noting that Disney has made some changes with ticket prices that could make your trip more expensive. Several days in 2022 now fall into higher price brackets than they did in the past. That means that your trip in 2022 might be more expensive than a trip for the same days in 2021 because some of those days may now be in a higher bracket of price/demand. This trend could continue and inflation might only make things more pricey!

Additionally, we saw that some multi-day tickets have increased in terms of their base price, and the range of ticket prices for the remaining available days in 2022 has also seen an increase for certain tickets. Basically, you may find that (1) the dates you’re looking to purchase tickets for now fall under a HIGHER price tier, and (2) select multi-day tickets will cost more as their starting cost per day has increased.

Click here to take a look at what we saw for 2022 Disney World ticket prices

We’ve also seen some sneaky price increases put in place for 2023 ticket prices.

Price Increases Generally

Putting aside tickets, inflation might result in higher prices for everything from food items in the parks to airfare costs, and it seems we’re already starting to see some of the potential effects of that.

It’s unclear if it’s due to inflation and inflation alone, or if other factors have caused this, but we recently saw HUNDREDS (literally…hundreds) of price increases made at restaurants throughout Disney World.

DOLE Whips, select popcorn refills, select popcorn buckets, Mickey waffles, Mickey’s Premium Ice Cream Bars, bottled sodas, Mickey pretzels, specialty alcoholic drinks, and so. much. more. all got a price jump recently. Some of these increases were small (just about 20 cents or so), but others were larger ($1, $2, and even $3). While they might seem small individually, they can certainly add up across the length of a trip, particularly one with multiple guests.

Whether this is due directly to inflation or other reasons, we’re already seeing higher prices in the parks when it comes to various snacks.

Click here to see the biggest takeaways from the price increases!

Inflation could also result in higher costs on other things like merchandise, hotels, and more. Basically, anything is up for grabs. During the Q4 2021 earnings call, Disney CFO Christine McCarthy said, in response to the question about inflation, that they could “look at pricing where necessary.” So even Disney has identified that costs for consumers might be a way to address inflation concerns, though McCarthy said they wouldn’t “go just straight across and increase prices;” they might consider other options too (more on that below).

We’ve also seen prices get quite high for other things, like rental cars, which might factor into your trip expenses. Price increases have already hit air travel and are expected to continue to impact flight costs. As reported by CNBC, one airline analyst indicated that demand for air travel is expected to continue to strengthen, and analysts “expect inflationary pressure in fuel and labor cost, as well as high-interest costs, to lead to higher ticket prices.”

So things in Disney World and things that are necessary to get you TO Disney World might increase in price due to inflation. All of that could result in a pricier 2022 trip than you might have anticipated.

Click here to see why renting a car could cost more than Disney World tickets!

Smaller Food Portions or Other Changes

Price increases might not be the only thing we see done as a response to inflation concerns. Disney might consider other routes like…smaller food portions? It’s true! During the Q4 2021 earnings call Disney CFO Christine McCarthy said that the team has thrown out a number of ideas like adjusting suppliers, substituting products, cutting portion sizes, and more.

McCarthy said this in response to the inflation question posed by the analyst during the call, but these changes may make some wonder if these are just the result of inflation or simply the result of Disney seeking to implement more cost-saving/cost-cutting measures. But if inflation means potentially higher costs for Disney on certain goods/services (as they mentioned with wages or other goods), which they then seek to pass down to the consumer, resulting in higher prices for the consumer — then the lines between inflation and cost savings could get blurred.

McCarthy also said, “we’re also using technology to reduce some of our operating costs, and that gives us a little bit of headroom also to absorb some inflation. But we’re really trying to use our heads here to come up with a way to kind of mitigate some of these challenges that we have.” So aside from price increases, we could see other changes.

Don’t be surprised if the products you’re used to getting in Disney World from a specific supplier change to another one. We saw this in the past in response to potential shortage issues with things like ketchup and POG juice, and now inflation might lead to similar results.

Click here to see what happened with POG Juice in Disney World!

Supply Chain Issues May Only Increase the Impact

We’ve seen supply chain issues impacting merchandise and food in Disney World and beyond, and these issues might only make things worse when it comes to inflation.

In the past, supply chain shortages have caused problems for the lightsabers in Tatooine Traders in Disney’s Hollywood Studios (though those have since returned), and lightsabers in Dok-Ondar’s Den of Antiquities in Disney’s Hollywood Studios (though some of those have also returned). We also saw a store entirely CLOSE in Hollywood Studios due to supply shortages, and Gideon’s Bakehouse temporarily discontinued one of its products due to a cream cheese shortage.

Supply chain issues can cause higher inflation, so that might cause higher prices; and just from a general standpoint, supply chain issues might make it more difficult to find things you want/need.

Click here to see how supply chain issues are impacting the Disney World lightsaber-building experience

It Could Impact Stock

Though this isn’t directly related to your experience in the parks, it is worth noting that inflation concerns are on the minds of many analysts and they could impact Disney stock values.

According to CNBC, Atlantic Equities wrote that “additional cost pressures were notable and ‘inflation is perhaps the most concerning,'” when it comes to Disney’s parks. Wells Fargo said, “Inflation is a risk (wages, product COGS).”

JP Morgan shared, “While there are increased costs associated with new attractions and inflationary pressures near term, we are confident that the parks can emerge from the pandemic with better profitability given the improvements the company has been able to implement, along with innovations such as Genie+. Its legacy Parks business has bounced back ahead of expectations, and we anticipate the segment emerging from COVID-19 with more profit upside longer term, despite some near-term costs pressure from inflation.”

So while some have faith in Disney’s ability to come back from these pressures, others seem a bit concerned. That could ultimately impact Disney’s stock value in the eyes of these analysts. In the first quarter of fiscal year 2022, however, Disney saw some all-time RECORD revenue numbers when it comes to the parks and some big Disney+ subscriber updates. But stock values have since dropped, so things could be changing.

Click here to read more about the BIG numbers Disney’s parks division saw in the first quarter of fiscal year 2022!

Some Things Remain to be Seen

Will inflation in wage costs mean Disney will hire fewer workers and guests will see that impact in the parks with fewer Cast Members? How much of these changes come from Disney just wanting to raise their own prices vs. inflation issues? Will inflation lead to higher costs trickling down to guests in more areas or a reduction of certain services that Disney no longer deems to be “worth it”? Will inflation lead to more “free” things becoming paid experiences to deal with some of the expenses the company has to deal with?

Much remains to be seen. For now, keep in mind that inflation could result in higher prices for various parts of your trip in 2022 or beyond. We’ll continue to look for more news and let you know what we find. Stay tuned for more updates!

Click here to see everything included with your 2022 Disney World resort stay!

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

WE KNOW DISNEY.

YOU CAN, TOO.

Oh boy, planning a Disney trip can be quite the adventure, and we totally get it! But fear not, dear friends, we compiled EVERYTHING you need (and the things to avoid!) to plan the ULTIMATE Disney vacation.

Whether you're a rookie or a seasoned pro, our insider tips and tricks will have you exploring the parks like never before. So come along with us, and get planning your most magical vacation ever!

How do you think inflation could impact a Disney trip? What impacts from inflation are you seeing? Tell us in the comments.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

LOL. Who’s Bob trying to kid? You can’t blame this all on inflation, or supply & demand. I see some good old fashioned greed in this.

So Bob is saying….business is so good, we’re going to charge more! Is that like gas companies saying,…We sell so much gas, we’re going to raise prices out of sight!

Hi all, after travelling across the pond every 2 years to Disney World we have decided that this will no longer happen. A review of all the changes hikes in prices and as AJ stated all the things that were free you now pay for has just made this appear that they are just out to rip you off. So it’s a big no for us, May just have to try Universal or no longer choose Orlando as a holiday destination.

It needs to be pointed out that Disney is not the only company raising prices because they can and/or consumers expect it. Until consumers make a concerted effort to reduce spending, companies will continue to raise prices.