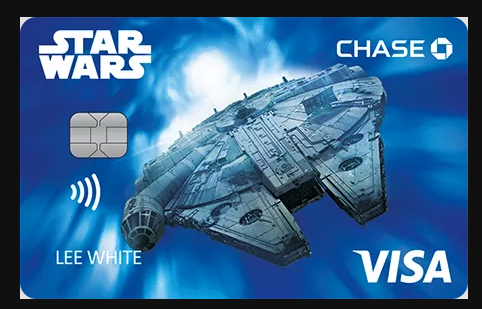

You’ve heard of Annual Passes, the Disney Vacation Club, and maybe even things like the Castaway Club, Club 33, and other “exclusive” Disney memberships — but have you heard of the Disney Chase Visa?

If you’re all about getting EVERYTHING Disney, then you might be thinking to yourself “how do I get this Disney credit card?! And how does it work?” Well, you’re in the right spot! Today we’re breaking down everything you need to know about just how the Disney Chase Visa works!

The Basics

Basically, the Disney Chase Visa is a Disney-themed credit card through Chase Bank (there are 2 types of cards) that lets you earn Disney Rewards Dollars for purchases made with the card. These Disney Rewards Dollars can then be redeemed into a Disney Rewards Card and used to buy items on shopDisney, in the parks, and more.

2 Types of Cards

Let’s start out with what cards are available. Technically, there are 2 different types of Disney Visa credit cards available — the Disney Premier Visa Card and the regular Disney Visa Card.

Premier Visa

The Premier version of the Disney Credit Card has a number of differences when compared to the “regular” version of the card. For starters, it has an annual fee of $49.

The new member offer for the card is also different than the “regular” card. If you are a new cardmember and you get the Premier Visa, you could earn a $300 statement credit after spending $1,000 on purchases within the first 3 months of opening the account.

With the Premier Visa, there’s also a difference in terms of how many points you earn for purchases. Premier Visa cardholders can earn 2% in Disney Rewards Dollars on card purchases made at select locations — specifically, gas stations, grocery stores, restaurants, and most Disney locations.

For all other card purchases, Premier Visa cardholders earn 1% in Disney Rewards Dollars.

Another special thing about the Premier Visa is that rewards dollars can actually be redeemed for a statement credit to use toward airline travel. Basically, what you’d need to do is purchase your airline tickets with your Disney Premier Visa Card on any airline. Then, you can “pay yourself back” by redeeming any of the Rewards Dollars you have toward a statement credit.

Noticing a price increase on your Disney World flight? You’re not alone!

Regular Disney Visa Card

So, how is the “regular” Disney Visa different than the Premier version? Well, for starters, the regular Disney Visa does NOT have an annual fee.

The new cardmember offer is also different. If you spend $500 on purchases within the first 3 months after opening your account with a new Disney Visa Card, you could earn a $150 statement credit.

The amount of points you earn with the “regular” Disney Visa is also different. There’s no opportunity to earn 2% here, like there is with the Premier Visa. Instead, “regular” Disney Visa Cardholders earn 1% in Disney Rewards Dollars on all purchases made with their card.

Also, “regular” Disney Visa cardholders can’t redeem their Disney Rewards Dollars toward a statement credit for airline travel. That’s exclusive to Premier Cardholders.

Click here to see the average cost to fly to Orlando in April of 2022

Benefits for Both

Now that we’ve gone over the basics of the card itself, let’s go over one of the most important things — the BENEFITS that come with the card! These benefits apply to both the Premier and “regular” Disney Visa.

No Limits

For starters, the big bonus here is that there are NO limits to the number of Disney Rewards Dollars you can earn, so the sky’s the limit when it comes to racking up the points!

Can Redeem Disney Dollars for LOTS of Things

The other big benefit is that you can redeem those Disney Rewards Dollars for lots of things — buying your Disney theme park tickets, resort stays, shopping (online and in person), dining at the Disney parks, movie tickets to see Disney films, and more!

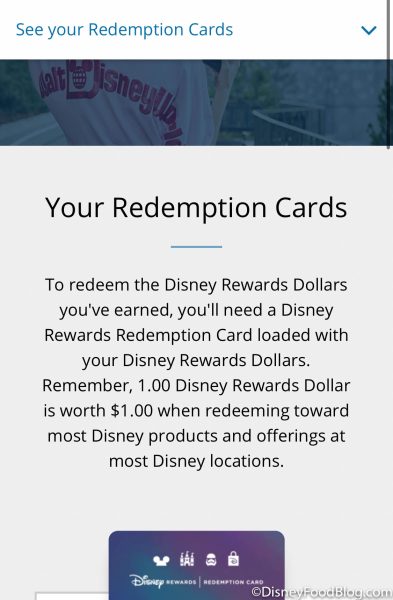

We’ll get into a bit more of how this works in a second, but basically you’ll (generally) redeem your Disney Rewards Dollars into a Rewards Card.

That Rewards Card then functions much like a regular Disney Gift Card would, allowing you to spend it on all kinds of things around the parks (and sometimes online).

Disney Cruise Line

When it comes to Disney Cruise Line, Disney Visa Cardholders can get a variety of different benefits!

Cardholders can get discounts on select Digital Photo Packages, select merchandise purchases on Disney Cruise Line ships, Castaway Cay getaway packages, and even select onboard spa treatments!

Click here to see what it costs to take a Disney Cruise

Merchandise Discounts

Disney Visa Cardholders can also get 10% OFF select merchandise purchases of $50 or more at select spots in Disney World or Disneyland. Just be sure to pay with your Disney Visa (and/or a Disney Rewards Redemption Card) and ask about the offer! You can visit the Disney Visa website to see what spots are NOT included for this discount.

Disney Visa Cardholders can also get 10% off on select purchases made on shopDisney. To get this discount, be sure to sign into your account, use the promo code DRVCMEMBER, and then pay for the purchase with the Disney Visa or a Disney Rewards Redemption Card.

Click here to see the official Disney candles that are now for sale ONLINE!

Dining Discounts

Disney Visa Cardholders can also save on all kinds of meals in Disney World and Disneyland! Specifically, cardholders can get 10% off select dining locations most days in Disney World and Disneyland.

At Disney World, the discount is valid at a variety of locations including Boma – Flavors of Africa, Toledo – Tapas, Steak & Seafood, Grand Floridian Cafe, Le Cellier Steakhouse, and MORE!

Some spots note that “restrictions apply” — that’s mostly a date-related restriction where there will be certain blackout dates on which the discount won’t work. But still, this could help you save a decent amount at a variety of table service spots throughout the Most Magical Place on Earth (and over at Disneyland too!). You can visit the Disney Visa website to see the full list of restaurants where it applies.

Click here to see our ranking of every single restaurant in Disney’s Hollywood Studios!

Access to Special Photo Opportunities in the Parks

Sometimes Disney Visa cardholders can also get special photo opportunities in the parks.

At the moment, these may not be available or may be more limited, but you’ll want to keep an eye out for potential Cardmember exclusive photo spots in Disneyland and Disney World.

Exclusive Access to Certain Perks & Limited-Time Offers

Sometimes cardmembers can also get access to items exclusively for them, like special collectible keys, pins, and more.

Cardmembers may also be able to get limited-time offers on things. You’ll want to check year-round for these unique discounts, exclusive merchandise opportunities, and more.

Vacation Financing

Vacation financing is another thing that might interest quite a lot of folks in this card. If your vacation qualifies (only certain vacation packages do) and you’re a Disney Visa Cardholder, you could get a promotional APR of 0% for 6 months on your trip. Qualifying vacations may be to Disney World, Disney cruises, Adventures by Disney, and more.

The key here is that you’ll have to purchase the trip with your Disney Visa Credit Card. The standard APR will then apply after that promotional APR expires.

The Disney Visa website also notes that cardmembers can get 0% promotional APR financing for 6 months on the “amount of the purchase of a real estate interest…in a Disney Vacation Club Resort” that is charged to the member’s Disney Visa Card. So if you’re thinking of becoming a DVC member, the card could help with some financing there too!

MORE Deals at Disneyland

In terms of other perks at Disneyland, Disney Visa cardmembers can generally get access to unique Magic Shots, 15% off select guided tours (when available), and even a discount at participant locations like Wetzel’s Pretzels or La Brea Bakery Cafe (with qualifying purchases).

Cardholders also currently have access to a special 2022 Disneyland Resort Vacation Package that comes with a Disney Rewards insulted cooler bag, a collectible pin and lanyard, and MORE!

The key here is to constantly look and see what deals might be available for cardholders at all of the resorts!

Other Disney World Deals

At Disney World, Disney Visa Cardholders can find exclusive Magic Shots, get 15% off select guided tours (including the Wild Africa Trek — mid-day tours only), get 10% off select recreation experiences (like horseback trail rides at Fort Wilderness!), and save at participating locations like Joffrey’s Coffee, Paddlefish, and more.

MORE!

Disney Visa Cardmembers can also get access to certain deals for Disney on Broadway shows, use their Rewards Redemption Card to buy tickets to see Disney, Pixar, Marvel, and Star Wars Movies through AMC Theaters, get fun card designs (including a 50th Anniversary design), and even save at Aulani, Disney’s Vero Beach Resort, and Disney’s Hilton Head Island Resort.

The pro tip here is to really search the Disney Visa website and Disney’s other websites to see where you can get benefits, as these benefits can change. When in doubt, ask if there is a Disney Visa discount — you never know when you might be surprised by one!

Also, be sure to check the Disney Visa online blog for little tips and tricks about visa points, free printable activities, and more!

How Many Points Can You Actually Get?

Wondering how many points you’ll earn on your regular, monthly purchases if you start using the Disney Visa card? Well, you can actually use a calculator on their website to see.

If, during a month you spend $100 at gas stations each month, $150 on restaurants, and $250 at grocery stores, you’d earn around 10 Disney Rewards Dollars per month with the Premier Card (120 Disney Rewards Dollars for the year), or 5 Disney Rewards Dollars per month with the “regular” Disney Visa (or 60 Disney Rewards Dollars per year).

One Rewards Dollar is equal to $1 (US) when it’s being redeemed toward most Disney products and at offerings at Disney locations, and for statement credits for airline travel if you’re a Premier Cardmember.

More About Disney Rewards Dollars

One important thing to note is that there are no block-out dates when redeeming Rewards Dollars (you may find block-out dates when using your Visa for discounts — but that’s different).

Another thing to keep in mind is that for most (if not all) of the perks and discounts above, you do need to use the Disney Visa card or a Disney Rewards Redemption Card to get the discount.

One BIG thing you’ll want to be aware of is that any Disney Rewards Dollars in your account will EXPIRE after 5 years! Want to make sure your points never expire? Then you’ll want to load them into a Rewards Redemption Card. Once you load them onto the Redemption Card they’ll NEVER expire!

You can also combine your Disney Visa discounts with your Redemption Card to get the maximum benefit. In other words, you can generally get a discount with your Visa and then also use your Redemption Card to pay for the item.

Each month, your earned Disney Rewards Dollars are posted to your Disney Rewards account. You can check them online or look at them through the Chase app to see how many Rewards Dollars you have.

You can also check to see the balance on your Disney Rewards Redemption Card, reload the balance of this card, and request another card if needed. You can have 2 Redemption Cards per account.

Also just note that if you return an item that you used your Disney Visa Card to purchase, you will lose the Rewards Dollars associated with that purchase once the credit posts to your account.

Step-by-Step Process

So, how do you get a Disney Visa card and redeem your Rewards Dollars? Here are the basics. First, you’ll apply for the card, which you can do through the Disney Chase Visa website. If approved, you’ll get the card. Remember there are lots of fun designs to chose from and you can change your design later if you want!

Then, you may want to download the Chase app so you can set everything up, track your spending, pay off your card, and see your points all in one spot.

In the app, it’ll show you your “Disney Rewards Dollars.” You can hit “Manage Rewards Dollars” to see more information. When you do that, it’ll show you how many dollars you have and what’s pending. You can also see certain details on the Disney Rewards website.

To redeem your points, you’ll need that Rewards Redemption Card. Again, this is basically a gift card that will hold all of your Rewards Dollars. You’ll load it with whatever points you have and then you can continue to reload it.

You can then use it to pay for your items online, in the parks, etc. To order your card, you have to have at least 20 Disney Rewards Dollars to load onto it.

Once you have the Redemption Card, you can reload it anytime you want with a minimum of 10 Rewards Dollars.

You can order or reload the Redemption Card online, on the phone, or in the theme parks at select locations.

And that’s the basics of the Disney Credit Card! What do you think? Is this a card you’d be interested in? Do you have this card? Tell us your thoughts in the comments below!

Check back with us for more Disney news!

Is Disney’s Memory Maker photo add-on worth it? See our thoughts here!

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

WE KNOW DISNEY.

YOU CAN, TOO.

Oh boy, planning a Disney trip can be quite the adventure, and we totally get it! But fear not, dear friends, we compiled EVERYTHING you need (and the things to avoid!) to plan the ULTIMATE Disney vacation.

Whether you're a rookie or a seasoned pro, our insider tips and tricks will have you exploring the parks like never before. So come along with us, and get planning your most magical vacation ever!

Do you have a Disney Visa? Tell us about your experience with the card in the comments below!

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

One important think to say.

This card is only for Americans

I live outside of USA and it is not available

This is the only problem.

I use my points to pay a good portion of my Disney Vacation Club dues ever year.

You also have to weigh the annual fee to the amount of annual rewards you get with the Premier card. If your rewards are less than the annual fee you’re basically paying for the redeemable rewards. It sort of cancels each other out.

Get the impression that everything is overpriced when you can get so many discounts…-hew…how is one to keep track of it.

I have the card. We use it constantly and rack up points for “special” items when we visit Disney. The discounts are a great plus, and the cards are just cute.

Have the card and have used it for vacation financing, for food and merch discounts, for special tours and paying our airline tickets! We received 15% off of Segway Tour in EPCOT when that was still an options! That was AWESOME! You can also put money on your redemption card and then pick the card up at the resort, which will save time and the fear that it will not get to you by your vacation time.

I have two cards, one for every day and one for the internet. They’ve worked well for me.

How long does it take for rewards points to be usable? I’m thinking about financing our trip there on a premier visa but want the points if possible to use on the trip so wondering how early I need to pay for the trip for the points to be available.

I’Ve had the premier card for several years now. I use it to pay for everything. I go to Disney once a year and use to rewards to pay for Food. So far, I’ve never had to pay out of pocket for any food Disney. Just make sure you pay it off every month.

Is this card available for people who doesn´t live in the US?

If I just book a hotel room and not a vacation package on the Disney site would I still get the interest free financing?

Can the Visa 10% discount be combined with the annual passport (Magic Key) discount in the parks? Or is it one or the other?

when does it make the most sense to use my disney visa discounts and when does it make the most sense to use my annual passholder discount?

Hi Hayley! You’ll have to look at which one gives you the most discount at the time, but if the discounts are equal, we recommend leaning toward the Visa because of the additional credit card rewards you may receive, but make sure you pay it off before the interest hits.

What vacation packages qualify? I have the premier card and considering doing this. Do you have to pay what balance is on the card before you can finance a vacation with it? What reasons would you be denied when trying to finance a vacation with the card? Thank you!

This is very late, but to answer Savannah’s question: yes, the vacation balance is separate from any other balance on the Card. Chase refers to it as an “interest saving balance”. Also, yes, vacation packages qualify. I think Disney Cruises do as well. Even the down payment qualifies, if you don’t pay the whole package at once. It’s pretty great! Just be very, very careful to pay it on when the interest finally becomes due!

Hello, My question is that will the points round up or down either at the end of each billing cycle or whenever you redeem your points?

My husband and I have had the premier card for several years now and typically use the redemption card to pay for our meals while at Disney World. The only thing I don’t like is the requirement to have earned at least 10 redemption points before you can transfer them to an existing redemption card. Another cashback card I have allows you to redeem any amount that you’ve earned.

The only negative I get frustrated about is that you can’t use your saved up rewards to pay for your actual trip. I had $600 in rewards and was hoping to deduct it from my statement for my trip, but you can’t.

I have this card and use it to accumulate points throughout the year to use at Disneyland for an annual December birthday trip .. BUT … if you revolve your balance and actually pay interest, it washes out the value of the points (dollars) you accumulate! To make it worthwhile – you really need to pay your balance in full every month.

Earned rewards no longer expire which is a nice change they made in early 2024. So you can now accumulate rewards beyond the old five-year expiration limit. I used to transfer earned rewards to one of my rewards cards when they were close to expiring; now that’s no longer necessary. Just let them grow!