Between the HUGE successes Disney+ has had with The Mandalorian, WandaVision, and Loki, and all of those subscriber fees it’s pulling from your pocket every month, the streaming service should be making megabucks, right? WRONG.

Disney+ is LOSING money on its streaming service at the moment and that’s no big secret in the investing world. But just how much money is Disney+ losing and does it actually matter? Let’s break it down.

How Much Money Is Disney LOSING on Disney+?

In Short, a Lot

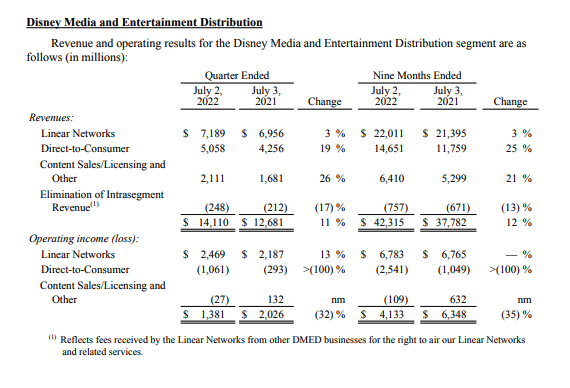

According to Disney’s earnings report for Q3 of fiscal year 2022, their entire direct-to-consumer side (which includes ESPN+ and Hulu) had a loss of $1.061 billion for the quarter that ended on July 2nd, 2022. That’s compared to a loss of just $293 million for the same quarter in 2021.

When you look at the 9 months ending on July 2nd, 2022, that loss is even bigger — at $2.541 billion.

In the earnings report for Q3 of fiscal year 2022, Disney noted that the operating loss in direct-to-consumer “increased $0.8 billion to $1.1 billion,” due to a “higher loss at Disney+, lower operating income at Hulu and, to a lesser extent, a higher loss at ESPN+.”

So, when looking at the previous year’s quarter, operating losses have INCREASED. As the SFGATE noted, “Despite Disney’s gains and the fact that its subscriber growth keeps going up and up, it’s actually losing money — and much faster than it was before.”

To be clear though, there was an increase in revenue, too. In Q3 of fiscal year 2022, Disney noted that “Direct-to-Consumer revenues for the quarter increased 19% to $5.1 billion.” Direct-to-consumer made about $5.058 billion in revenue in that quarter, compared to $4.256 billion in the prior-year quarter.

But you do have to keep in mind that this all reflects revenues and operating losses at ALL of Disney’s direct-to-consumer platforms (which includes ESPN+, Hulu, and Disney+). Disney doesn’t separate it to identify what percentage of the loss or revenue comes from Disney+ alone. Still, they do acknowledge that Disney+ IS losing money, and a lot of it.

What’s Causing the Loss?

You might be wondering just why Disney+ is losing money, considering its hit series, popular movies, and tons of subscribers. There are a variety of things prompting this loss.

First, let’s turn to the Earnings Report for Q3 of Fiscal Year 2022. In that report, Disney said that the lower results at Disney+ specifically during that quarter were a reflection of “higher programming and production, technology and marketing costs.”

Disney went on to note that the “increase in programming and production costs was primarily due to more content provided on the service.”

And Disney noted that the increase in technology and marketing costs reflects some growth being made in existing markets and, to a “lesser extent, expansion to new markets.”

Let’s break that down a bit.

Investment in Disney+ Content

One big thing we know is that there is a LOT of investment being made into Disney+ programs.

Back in 2020 Disney shared that across all of its direct-to-consumer services, it expected to spend between $14-$16 billion on content through fiscal year 2024. About $8-$9 BILLION of that was meant to be set aside for Disney+ specifically.

Some sources indicate that a single episode of The Mandalorian is said to cost $15 million, while Marvel shows like WandaVision or Hawkeye have been said to cost as much as $25 million per episode. In other words, it takes a LOT OF MOOLAH to make the shows we know and love on Disney+, and more of those shows and movies are on the way, which equals more spending.

During the Q2 earnings call for fiscal year 2022, Disney CEO Bob Chapek said “we believe that great content is going to drive our subs, and those subs then in scale will drive our profitability.”

Why spend so much on creating content? Fans constantly want new things to watch, and so the “hungry beast” must be fed — as Disney CEO Bob Chapek put it. During one interview, Chapek noted that back when they first launched Disney+ they “dramatically underestimated the hungry beast” (referring to Disney+) and “how much content it needed to be fed” to really maximize its potential. For a while, it appears they even “stole” content that was supposed to go to other places to feed the need on Disney+.

And now the content creation continues. Within the next few years alone, Disney+ is set to get Disenchanted, Hocus Pocus 2, a National Treasure series, a Percy Jackson series, Willow, a Tiana show, a Zootopia show, and SO much more.

Promote Direct-to-Consumer Platforms

It also seems like Disney might be spending even more money to promote its direct-to-consumer platforms than it expected to. This has to do with the technology and marketing losses Disney noted due to growth in existing markets and new markets.

In the annual report for fiscal year 2021, Disney noted that, as a Company, their “Selling, general, administrative and other costs for fiscal 2021 increased…to $13.5 billion, due to higher marketing costs at Direct-to-Consumer and Linear Networks, partially offset by lower marketing costs at Content Sales/Licensing.”

The Motley Fool notes that in Q2 of fiscal year 2022 alone, Disney’s direct-to-consumer segment reported $839 million in “other operating expenses,” and “$1.29 billion in sales, general and administration (SG&A expenses).”

So it looks like they’re spending a lot to get the word out there about Disney+ to gain more subscribers, which should ultimately result in greater revenue in the long haul. As they say, sometimes you’ve got to spend money to earn it! 💰

Penalty and Licensing

But some of the losses at Disney+ may also have to do with a penalty Disney had to pay to end a customer license agreement early in order to get some content on Disney+. According to SFGATE, some speculated that this had to do with Marvel shows like Daredevil and Jessica Jones that suddenly moved from Netflix to Disney+.

Disney, as a whole, also appears to be scaling back on third-party content licensing, which is impacting things. During the Q3 earnings call for fiscal year 2022, Disney’s Chief Financial Officer, Christine McCarthy said that as they continue to “scale back on third-party content licensing” they believe that “content sales, licensing and other results will continue to face headwinds and expect fourth quarter operating results will decrease versus the prior year.”

Average Monthly Revenue Per Subscriber

On top of spending lots of money on content, pulling their content away from other sources, and spending money on marketing, the average monthly revenue per Disney+ subscriber has decreased recently.

In Q2 of fiscal year 2022, the average monthly revenue increased. But in Q3 of fiscal year 2022, things went down. Disney shared that the “average monthly revenue per paid subscriber for domestic Disney+ decreased from $6.62 to $6.27 due to a higher mix of subscribers to multi-product offerings.” In these “multi-product offerings” — like bundles with Hulu — Disney+ might be included at a cheaper price, thereby reducing how much money Disney is getting from each person.

The good news? The average monthly revenue per paid subscriber for international Disney+ increased during the last quarter. And the monthly revenue per subscriber has gone up in past quarters, so things could change in the future.

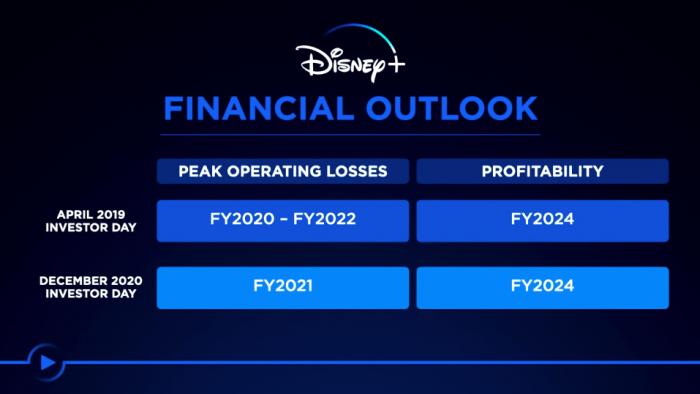

Disney+ Won’t Be Profitable For a WHILE and Disney Knew That Going In

Disney hasn’t been hiding the fact that Disney+ is losing money. In fact, it knew that Disney+ wouldn’t be profitable for a while and it has provided guidance on that for quite some time. As Chapek puts it, they gave profitability guidance even before that was a true focus for investors.

Chapek said, “We knew that the frothiness of the streaming business in the eyes of investors would moderate at some point, we didn’t know when. And profitability would become as important if not more important ultimately than revenue and sub adds.”

Thus far, Disney has projected that Disney+ will be profitable by 2024. It made that statement back in 2020, and Disney reaffirmed that guidance in 2022.

During the Q3 earnings call for fiscal year 2022, Christine McCarthy said that they “remain confident that Disney+ will achieve profitability in fiscal 2024 and look forward to several upcoming catalysts, including reaching a steady state of tent pole original content releases, delivery of premium general entertainment and international local originals and the upcoming launch of our ad-supported tier, alongside the new pricing structure.”

So Disney expects Disney+ to become profitable in just a few short years, but it also knows how to cover its bases in case things don’t quite go as well as hoped…

Disclaimers

Within its earnings reports, Disney places a number of disclaimers that undoubtedly have been insisted upon by the company’s lawyers and financial advisors. In its annual financial report for fiscal year 2021, Disney noted, “There can be no assurance that our DTC [direct-to-consumer — meaning Disney+ and other streaming services] offerings and other efforts will successfully respond” to changes in things like declines in linear viewership or decreased advertising revenue.

They also caution, “There can be no assurance that the DTC model and other business models we may develop will ultimately be as profitable as our existing or historic business models.” In other words, take their optimism with a grain (or maybe a HEAPING) of salt.

Basically, Disney is fully acknowledging that the streaming world is risky. Things might not go to plan. But that risk might just be worth taking if they can hit the profitability and subscriber numbers they’ve set as their goals.

Subscription Fees Are CHANGING and That Could Impact Things

Disney itself has acknowledged that the majority of Disney+ revenue is derived (at this time) from subscription fees. That makes increasing subscriber numbers a HUGE deal.

During the Q3 earnings call for fiscal year 2022, Disney revealed that they had a total of 152.1 MILLION Disney+ subscribers. That was higher than what some analysts predicted and was a 31% increase since July 3rd, 2021.

While that’s some great growth for the year so far, things might take a turn. During the Q2 earnings call for fiscal year 2022, Christine McCarthy said that while they still expect an increase in Disney+ subscribers for the second half of the year, the first half of the year came better than expected. She cautioned that the delta they had initially anticipated might not be as large, but that they still expected to see an increase in the second half of the year.

A slowdown in subscriber numbers could be bad for revenue. But things could balance out considering Disney’s incoming increase in prices.

In 2022, Disney will be INCREASING the prices for their Disney+ ad-free service and will introduce an ad-supported service (which will cost the same as the current ad-free service).

If people end up paying the increased price for the ad-free service, that could signify a big boost in revenue, even if the number of subscriber additions is lower than it had been previously.

But if people don’t want to pay more for the ad-free service and they become frustrated with watching ads on the ad-supported service, there is a risk that they will drop the subscription altogether and that would have a negative impact.

The other concern some have is that a decent portion of Disney+ subscribers come from places where Disney+ is included at a very low cost. This was actually something CNBC asked Chapek about in 2022. The interviewer questioned whether Chapek was concerned that the growth in subscriptions would come from those that aren’t as “valuable” from a revenue perspective.

Chapek insisted that they expect to see subscriber growth (whether domestic or international), reaffirmed their profitability expectation for 2024, and noted that the “core” subs (those that are not through Disney+ Hotstar) are valuable and that they do expect to see domestic growth. Only time will tell.

Ads Could Also Change the Scene

When it comes to profitability, Disney+’s main source of revenue has been subscription fees. But Disney+ Hotstar (Disney’s streaming service in India) has been able to generate advertising revenue, and soon Disney+’s domestic product will too.

Disney+ Basic (which will have ads) will launch in the U.S. on December 8th, 2022 for $7.99 per month. Even though Disney won’t allow for certain ads and will only run ads for an average of 4 minutes per hour or less, that additional source of revenue could push Disney+ toward reaching its profitability goal.

Does It Matter?

So we’ve gone over how much money Disney+ is losing, why it’s losing money, and how ads and increased fees could change things. But now we get to the big question — Disney+ is losing money, but does it even matter?!

It depends.

Maybe It DOES Matter

Some have suggested that shareholders might start asking tougher questions about the profitability of Disney+ and how much money it is losing since they are seeing the losses increase. It’s not like Disney+ is losing 2 cents or $5 here and there. We’re talking some big money here. So yeah…the piggy bank isn’t exactly never-ending, and those who fund the piggy bank might start to ask harder questions about what the future will hold.

Others have noted that Disney might need to “tell investors a new story.” Adding new subscribers might just not be enough anymore. If the second-half growth in Disney+ subscribers doesn’t “WOW” investors, they might need to lean more heavily into good news (if any) on the profitability front to keep investors from getting too concerned.

Following the announcement of big Disney+ subscriber growth (coupled with some seriously BIG revenue at the parks), Disney’s stock value did go up, but it has since taken a bit of a tumble. While it seems the good news of subscriber growth could have helped fuel a little bump in stock values, it wasn’t enough to keep a high value for a more sustained period of time. Profitability might become the point investors will focus on for longer-term stock confidence.

As CNBC points out, investors used to not really care if a company was losing money with streaming or spending a lot on new content because the companies were in “land grab” mode — just getting all of those new subscribers. But one portfolio manager warns that the “land grab” phase has ended and now it’s about “consolidation and rationalization.”

If a huge growth in streaming isn’t coming, what is there to look for in terms of company value? Disney+ profitability might be the answer, or Disney might need to focus more on its other sources of income to keep investors feeling positive about the company as a whole.

But, Then Again, Maybe Not

But maybe Disney+ profitability still isn’t the key some think it is. Many analysts still seem to be very focused on subscriber growth. When articles are written ahead of and even sometimes immediately after the earnings reports’ release, you often see subscriber number predictions/results mentioned and harped on.

And considering that the majority of Disney+ revenue comes from subscription fees (at the moment), that focus on subscriber growth makes sense — it links future profitability to subscriber growth in a way that is easy to measure right now.

The other thing to consider is that Disney+ is just one piece of the Disney Company puzzle. The company has diversified its involvement in various businesses and for some investors, that may be a greater focus.

Things like theme parks, the cruise line, hotels, theatrical movie releases, merchandise, etc. could be a greater focus for some. And considering that revenue for the Disney Parks, Experiences & Products division increased by $4.3 BILLION in Q3, some investors may choose to focus their energy on other parts of the business until Disney+ is closer to that fiscal year 2024 mark.

Speaking of 2024, it’s a good reminder that Disney still has time to meet its goals. Even if there is a temporary slowdown in subscriber growth, there is time to adjust and take steps to reach profitability.

And it looks like some analysts are hopeful for the future. According to the Hollywood Reporter, Wells Fargo analyst Steven Cahall wrote, “It now looks like Disney+ is tracking towards tightened and trimmed sub guidance, while the ad-supported tier + price increases + content rationalization = a much improved long-term profit outlook.”

We’ll continue to look for more details on Disney+. In the meantime, click here to learn about a NEW series coming to Disney+, or click here to see Chapek’s full comments about the “hungry beast” that is Disney+.

This is a lot of news to take in, right? We’ve got a little fun break for you now – check out all the new Disney-themed graphic tees and more in our merch store by clicking here!

Click here to see why Disney+ could cost you more soon

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

What do you think? Do you expect Disney will hit the Disney+ profitability goals it has set for 2024? Are you surprised to learn that the service is losing money? Tell us in the comments.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Hard to show profit when you give D+ for free to Hulu subscribers and entice paying customers to renew an $80 yearly subscription with $150 worth of gifts.

Bob Paycheck needs to go!