Something that is critical to the way Disney World currently functions is plagued with uncertainty right now.

For years, Disney World has had a large amount of control over the land on which it operates in Florida thanks to the Reedy Creek Improvement District (RCID). Essentially, the RCID has allowed Disney to (in many ways) function as its own county government. Through the RCID, Disney has imposed and collected taxes on its land, issued bonds, and made all kinds of other decisions without some of the typical oversight that hinders other developers. But all of that is about to change.

The Impending Dissolution (Getting Caught Up)

If you’re unfamiliar with the situation, let’s do a quick catch-up session. In 2022, a law was passed by the Florida legislature, and later signed by the Florida governor, that will DISSOLVE the RCID by June of 2023, unless a new agreement is reached. This all took place after Disney spoke out against Florida’s Parental Rights in Education Bill (what critics call the “Don’t Say Gay” bill).

Lawsuits have been filed regarding the dissolution of the RCID and the impact it would have on local citizens. One big concern surrounds what will happen with the tax burden of the RCID (including about $1 billion in bond debt) if the district is dissolved. One lawsuit is still pending in Miami-Dade County, Florida and there really hasn’t been much of an update there.

Florida Governor Ron DeSantis previously indicated that the state government would likely control the Reedy Creek District. Other sources have indicated that a successor district will likely follow the dissolution of the RCID, but not much has been specified in terms of what that district will look like or who will truly control it.

More recent reports seem to indicate that while a new district could be created, any changes made to the district would be “superficial” and won’t interfere with the business the RCID needs to get done. According to state Senator Linda Stewart, Disney doesn’t want to relinquish control of the district but may consent to state representation on the board.

In mid-September, we shared a look at what was going on with the RCID at that time — we analyzed information about Disney’s unique power over the situation, updates on ongoing work at the RCID, and a surprising update on its bonds.

So what’s going on with the RCID right now? Let’s take a look.

UPDATE: Big News Could Come Soon!

While much of the future for the RCID remains uncertain, we could get a big update soon. According to the Orlando Business Journal, a special session of the Florida legislature that’ll take place after the November 8th election could finally give the RCID some big answers.

David Ramba, the executive director of the Florida Association of Special Districts Inc., shared that there are conversations going on in Tallahassee about the RCID and state leaders are working on a plan.

The legislature is set to have a special session in December on insurance, and Ramba said “they could add this to the call to adjust that [sunset dates] portion of the bill.”

Update: A Few Options for the Future

In addition to noting that the future of the RCID could come up during the December special session, Ramba discussed some of the options state lawmakers might take.

First, the state could delay the June 2023 date on which the RCID is set to be dissolved under the current law. Ramba noted that they could vote to delay that date and give themselves another year (if need be) to really hash out their plan for the future.

Another option would be for the state to, instead of fully dissolving the RCID, simply amend certain powers that the RCID currently holds, like the ability to build a nuclear power plant.

If the RCID ultimately is dissolved, another option would be for the state or local governments to change the wording in the RCID’s charter or replace it. But that would require a 30-day public notice, discussions, and approval by certain delegations within the counties being affected (in this case, Orange and Osceola counties), and more steps. That would delay things but could be a possibility.

Ultimately, however, Ramba thinks a solution will be found. He shared, “I don’t think [the state] will allow anything to implode…I don’t think anyone should be nervous about it.”

He noted that entities like Disney will likely get a district of some kind that still does the things it needs the district to do, while also “allowing the state to level the playing field for other similar businesses.”

A Budget for 2023

The RCID is governed by a Board of Supervisors. The Board’s next meeting is set to take place on October 26th, 2022.

But while we wait for updates from that meeting, we do have some news from recent meetings.

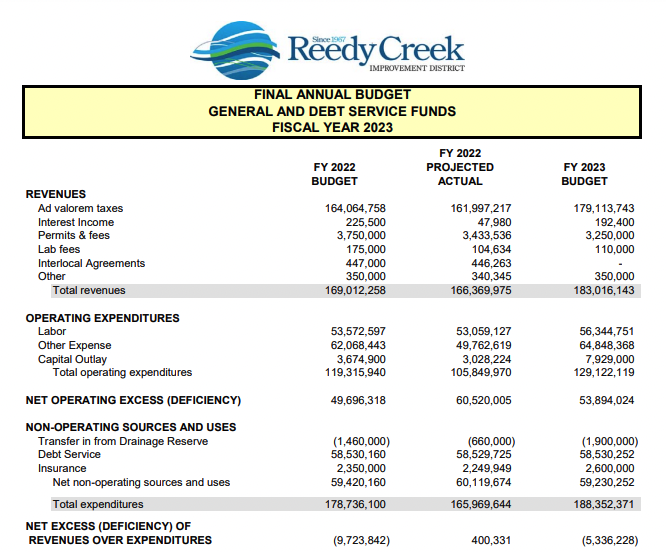

The fiscal year 2023 RCID Budget has been uploaded to the District’s website and it shows what 2023 could look like for the RCID. In terms of revenues, the 2023 budget calls for around $183 million in revenue — that’s an increase compared to the $169 million that was listed for the 2022 budget.

In terms of expenditures, 2023 is set to have just over $188 million in expenditures, an increase from the $178.7 million that was listed for the 2022 budget. All in all, it looks like there is a deficiency of revenues compared to expenditures of around $5 million projected for the 2023 budget.

When it comes to taxes, there is a change coming to the millage rate. The millage rate is the amount per $1,000 used to calculate taxes on property. (Naples.gov) In the RCID, the millage rate was around 13.57 for fiscal year 2022. That’s set to increase to 13.9 for fiscal year 2023 — marking a slight increase.

So, overall, the big takeaway here is that the RCID is continuing to plan for its future, uncertain though it may be, and 2023 is looking like it could be a year of big revenues and big expenditures too.

Uncertainties With the RCID Staff

The RCID has its own set of firefighters, but uncertainty about what the district could look like in the future has raised some concerns. In a video posted by WFTV 9, Jon Shirey, the union president for the Reedy Creek Fire Department, shared that there was a lot of “anxiety” and “confusion” about what was going on.

Shirey shared that there was a lack of reassurance about the safety of their jobs in the district. According to Channel 9, the union is concerned that the dissolution could strain reported staffing issues. There is a concern that firefighters will simply look for jobs elsewhere now, rather than wait to see what happens next.

In April of 2022, the Orlando Sentinel also noted that firefighters were concerned about benefits like lifelong health insurance, that is available to those who meet certain requirements. At that time, Shirey shared, “For our retirees who plan their lives and their finances around a benefit that they were promised for life, this is incredibly concerning.”

Much of the next steps still remain a mystery, so we’ll be on the lookout for details.

Florida Gubernatorial Race and Disney Implications

In terms of Florida politics more generally, Governor DeSantis is currently involved in a gubernatorial race against candidate Charlie Crist.

If you anticipated that DeSantis’ relationship with Disney, his involvement in expanding the special session of the Legislature to allow them to consider eliminating the RCID, and his overall support for the dissolution of the RCID and the removal of Disney’s “special privileges in the law”, would be brought up in the gubernatorial race, you might be right.

During an October debate, Charlie Crist said, “I’m not the governor who attacked Walt Disney World because they…expressed their point of view…that’s you.”

Though Crist did not explicitly discuss the RCID’s dissolution, the dissolution did come soon after Disney spoke out against the “Don’t Say Gay” law.

I'm not the governor who attacked Walt Disney World and our hospitality industry. Ron DeSantis is the most anti-business Governor I've ever seen. #FLGovDebate pic.twitter.com/zCiMBx5cBH

— Charlie Crist (@CharlieCrist) October 24, 2022

Whether Disney will continue to be a point discussed in the election remains to be seen.

Uncertainty With Bonds

When it comes to the bonds that have been issued by the RCID, we previously shared that the uncertainty surrounding the RCID made the value of the bonds subject to speculation in a way that’s not usual for them. For some, that actually increased their attractiveness, and bond purchases actually increased in certain periods when compared to 2021.

So what’s going on with the bonds now? Well, Fitch Ratings has shared that they’ve maintained a rating of “AA” on the Issuer Default Rating and “Rating Watch Negative” when it comes to the RCID bonds. According to their report, the RCID actually has about $686 MILLION in outstanding ad valorem tax bonds.

Fitch Ratings placed the ad valorem bond rating for the RCID on “Rating Watch Negative” back in April of 2022 because of the passage of the law that will dissolve the RCID in 2023.

Fitch noted that it’s keeping the Watch Negative rating because it “reflects the lack of clarity regarding the allocation of RCID’s assets and liabilities, including the administration of revenues pledged to outstanding bonds and the servicing of debt in the event of dissolution.”

But things could be changing. Fitch shares that their “baseline expectation” is that there will be some legislation introduced in the Florida Legislature during the next general session (which is expected to start on March 7th, 2023, and run through May 5th, 2023) that’ll help clarify things.

They expect the legislation introduced will “resolve the uncertainty and ensure the timely repayment of RCID debt.” Fitch expects to review the bond rating again “once the uncertainty is resolved.”

Based on the update above, it’s possible the RCID will be addressed by the legislature even sooner than March of 2023.

But it’s not all good news. The bond rating for the RCID could go DOWN if there is “prolonged uncertainty” regarding the dissolution, litigation, or other things that “alter security provisions and/or the capacity for repayment.”

Fitch points out that if a new district is not created to replace the RCID, all of the RCID property and indebtedness will be transferred to Orange County and Osceola County, or to the cities of Bay Lake and Lake Buena Vista.

Fitch noted that the RCID has had “strong operating performance” and utilized “prudent management practices,” in the past. In terms of the future, Fitch shares that they expect the RCID will continue to manage its budget prudently though its future remains uncertain, “reflecting management’s track record of preserving a high level of fundamental financial flexibility through prior periods of economic uncertainty.”

Only time will tell whether Fitch’s expectations about legislation addressing the RCID will become reality, or if continued uncertainty will drop the bond rating for the RCID.

Could the Dissolution Be GOOD for Disney?

When it comes to the RCID, we’ve long gone over why the dissolution of the district could be a “disaster” for the Company. But, could it (from a different perspective) be beneficial for Disney? Some think so.

In speaking with The Washington Post, Christina Lewellen, an accounting professor at North Carolina State University, said that Disney actually could save hundreds of MILLIONS of dollars if the RCID is actually dissolved. It would no longer need to handle many of the expenses it takes care of now.

If the burden for the RCID expenses falls to the local citizens, Disney could save money but local citizens would potentially have to pay more taxes.

Lewellen shared that in dissolving the RCID, “They were trying to hurt Disney potentially and make their life more difficult, but yet in the end, from a monetary standpoint, they might end up better off.”

There are a lot of uncertainties that still need to be resolved — Will a successor district be made before that June 2023 dissolution date? What will it look like? Who would control the new district? If a new district doesn’t get created, then what will be the burden to local taxpayers? How involved will Governor DeSantis be in the matter? What role will the state play (if any) in the new district?

We’ll have to wait and see. In the meantime, be sure to check back with us for more updates as the situation moves along.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

TRENDING NOW

Park Pass Reservations are sold out for Magic Kingdom for three dates in 2025 already!

In September, the South Florida Water Management District requested some additional information for the permit,...

Beware of this new airplane travel trend the next time you fly.

The Jim Henson Company's studio lot is being sold to a famous celebrity!

Let's step inside the new store to see what we can find!

When we say that this time of year is BUSY, we really mean it. Here's...

Let's see what's in store for TV in 2025.

Cases of a flesh-eating bacteria have significantly increased in Florida, the reason why might surprise...

Is this the end of an era? WE HOPE SO!

Since you said you were looking for some deals on Disney Loungefly Mini Backpacks, we've...

We asked and you delivered -- you told us 6 things that happened in Disney...

Everyone is getting in on the holiday cheer at Disney World, even the Disney horses!

This new Disney World menu might have made one of our favorite Disney restaurants even...

Disney World is EXPENSIVE, but saving on dining can be a huge help for your...

We are begging Disney World to reopen this very popular location at Disney Springs!

After YEARS of Disney World hotel stays, there are two items we keep using on...

The show's 80+ year run is about to end.

A brand-new Stanley collection has just landed at Target!

Book a spot on a Mears Connect bus and cross your fingers that you get...

Staying at a Disney World hotel and wondering if this optional perk is worth the...