Bob Iger is back as Disney’s CEO and the Company is already being affected in a key way.

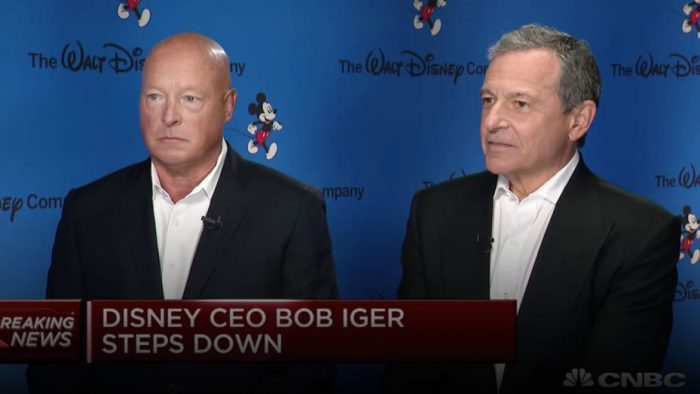

Late on Sunday night (on November 20th), the Disney Company announced that Bob Chapek (who took over the CEO role suddenly in 2020 and whose contract had recently been extended for several more years) had stepped down and Bob Iger would serve as the Disney CEO once again for 2 years. So just what has already changed at Disney following this news?

If you’re an investor or a Disney stockholder, you’ve likely already seen the impact the announcement of Bob Iger’s return to Disney has had on the stock value.

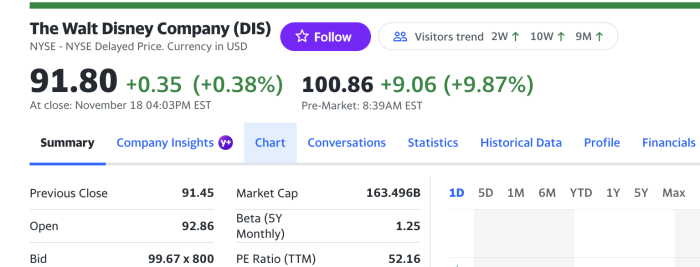

According to Yahoo Finance, stock for the Walt Disney Company closed at $91.80 on November 18th (this was before the news of Iger’s return).

On the morning of November 21st, just hours after Disney announced that Iger would return as CEO, the stock was trading at $100+ in the pre-market.

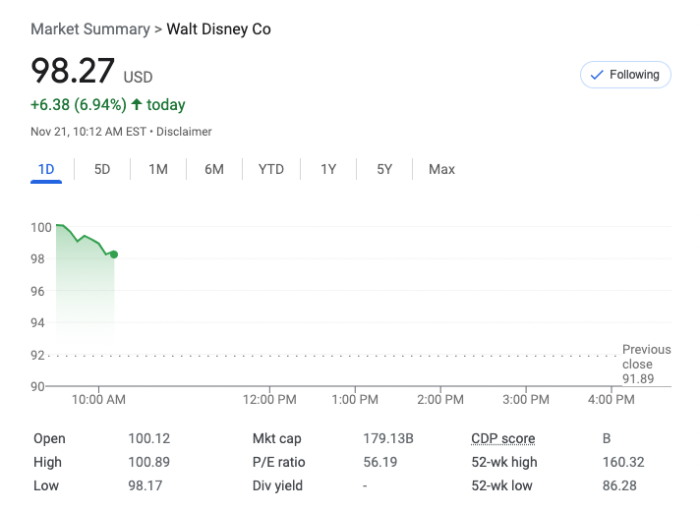

Google’s stock figures show that the opening price for the stock was $100.10 on November 21st.

Since the early morning hours, stock values have changed a bit. As of around 11:10AM (ET) on November 21st, the stock was trading at about $98. Though this is lower than its opening value, it does mark a pretty significant jump from the $91-$92 the stock was trading at just days before.

Of course, it’s important to keep in mind that Disney stock values have changed a LOT over the past few years. Just one year ago, while Bob Chapek was CEO, Disney stock was trading at around $154. But a lot has changed in a year as far as investors are concerned.

Here’s a look at the stock value over the last 5 years. The stock dropped to some incredibly low levels following the pandemic-related closures and following some other news in recent months but it has also hit some record highs during former CEO Bob Chapek’s tenure.

According to the New York Times, pressure had been building for some changes as stock values tumbled. Iger reportedly told confidants he was “devasted” by Disney’s decline.

Bloomberg has pointed out that today’s increase in the stock has been the most the shares have risen in nearly 2 years. It was the biggest intraday gain since December 2020. The change has even prompted Analyst Michael Nathanson to raise MoffettNathanson’s rating of the stock to “outperform” (from “market perform”). He has also applauded Disney’s Board of Directors for making the change.

But it’s not all good news with Iger’s return. Nelson Peltz’s fund management firm Trian reportedly is opposed to Iger’s rehiring. The firm has reportedly pushed for a seat on the Board of Directors at Disney to “advocate for more cost cuts.”

Additionally, Iger has some big challenges ahead, including “reversing the steep decline in Disney’s shares, which are headed toward their worst annual loss since at least the 1970s.” He’ll also have to tackle reining in spending on Disney+, obtaining growth for Disney+, and managing a “declining cable-TV business.” But in a note to employees, Iger shared “These times remain quite challenging, but as you have heard me say before, I am an optimist.”

Only time will tell how Bob Iger’s return to the CEO position will further affect Disney’s stock values. We’ll continue to keep an eye out for updates.

In the meantime, check out our full post about Bob Iger’s return to Disney following Chapek’s exit

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

Do you own Disney stock? Will you be buying some soon? Tell us in the comments.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Thank God

Just goes to show how much of a Cancer Chapek was to the company. Ironically, not only will he walk away with a hefty severance package, as a share holder he’ll make even more money as Disney stock value increases.