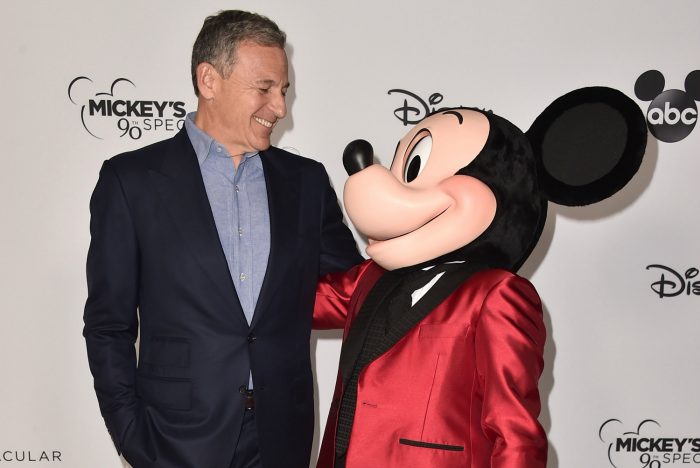

We’ve been keeping a close watch on Disney stock prices since the return of Bob Iger as CEO.

When it was announced that Iger would once again come aboard to lead the company, stock prices jumped. They’ve remained steady, even nearing $100 a share at times — and prices haven’t dipped below $94 since Iger’s return. Until recently, that is. Disney stock dropped quite a bit on Monday, and we’re taking a look at why that might have happened.

Before Bob Iger returned to The Walt Disney Company as CEO, Disney shares closed at $91.80 on November 18th. On the morning of November 21st, right after the Iger announcement was made — Disney stock was trading at $100+ in the pre-market, with an opening price of $100.10.

This marked the most Disney shares had risen in nearly two years — and a good sign of what was to come under Iger’s second round as CEO. Stock prices have remained relatively steady since then, and on December 5th, shares were just under $100.

But stock values still aren’t where they need to be for The Walt Disney Company, as just one year ago Disney stock was trading at around $154, under Bob Chapek as CEO. Shares also hit record highs during Chapek’s tenure.

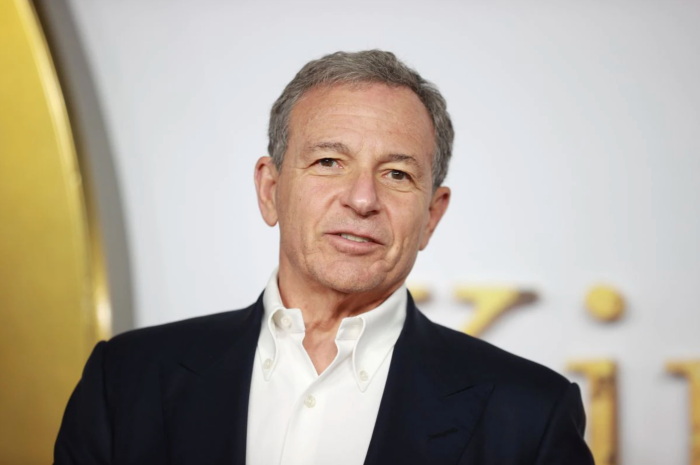

And now, Disney stock has dropped quite a bit for the first time since Iger’s return. The more than 4% drop came Monday morning, with shares closing at $85.78. This marks a 52-week low, and an over 40% drop overall in the past year, according to CNBC. As of Tuesday morning, pre-market shares were hovering around the same price with Disney stock performance well on its way to being the worst in five decades.

It’s worth noting that this decreases comes after Avatar: The Way of Water performed worse than expected at the box office on opening weekend. The film had been expected to be a box office hit for Disney, but it only brought in $134 million — short of the $175 million analysts predicted and the $135 to $150 million Disney had expected.

But, not all hope is lost for the latest Avatar film, as the original movie made only $77 million opening weekend, and later became the highest-grossing film of all time.

So, is this less-than-stellar opening weekend performance the reason for Disney’s stock prices falling? Chances are that’s part of it, but the initial excitement over Iger’s return has most likely started to subside for many experts and fans alike. Disney has had to deal with challenge after challenge since the pandemic, and just because there’s a new CEO doesn’t mean those hurdles will immediately be cleared.

History has shown that it’s not always smooth sailing for “boomerang CEOs” like Iger. A study published by MIT Sloan Management Review in 2020 showed that companies that brought a former CEO back have “significantly lower” stock performance than those that put someone new in the position.

Iger has been tasked with re-evaluating “several of the recent strategic initiatives and corporate restructurings over the past two years, which could create some near-term uncertainty on direction of the company,” according to Bank of America analyst Jessica Ehrlich.

This uncertainty with the company likely doesn’t bode well for Disney stock prices, as only time will tell what that restructuring might look like.

But, investment firm Wells Fargo thinks Disney could part ways with ESPN and ABC — as soon as next year, according to Seeking Alpha. Analyst Steve Cahall, shared that this split would make Disney “an attractive pureplay IP company” and could be some of the “big changes” Iger has up his sleeve.

Cahall continued, “With linear and sports trends diverging from core IP, we think severing the company is increasingly logical.”

If Iger and Disney did decide to spin off ESPN and ABC, analysts believe the company “would trade at 16 times enterprise value-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) and the company can move forward with a strategy focused on intellectual property, while ESPN works on sports.”

We’ll be sure to keep an eye on Disney stocks and any changes Iger makes at the company. For more on Iger’s return as CEO, check out:

- Disney Announces “Organizational and Operating Changes” As a Result of Bob Iger’s Return

- “They Brought This on Themselves” — Governor DeSantis Responds to Disney CEO Bob Iger’s Comments on Florida Legal Battles

- Will Bob Iger Reverse Bob Chapek’s Decisions?

- Disney CEO Bob Iger Comments on Reedy Creek and & Don’t Say Gay Controversy

- CEO Bob Iger Comments on Disney Park Pass Reservation System

Stay tuned to DFB for more Disney news and updates.

Every Major Change Since Bob Iger Returned as Disney’s CEO

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

What do you think Bob Iger’s first big move will be? Let us know in the comments!

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Be cautious when looking at Disney stock in a bubble. The overall market had a poor day on Monday. Anyone comparing stock from day to day or even month to month doesn’t understand how financials function. This is a long-term game.

The waste of Executive staff that do nothing. Board members that waste money and time. The several Golden Parachutes that have Cost me the small stock holder are robbed the returns and value of the stock

I smell stock split.

Okay if Disney wants to bring back the Magic then lower the ticket prices and allow all to enjoy what was once “Magical”

And bring back the Magical Express. Reinstate the dividend the help defray some of the rising Costs the customers endure at the parks!

Have the Chairman begin the program: “Bringing Back The Magic “