Let’s just say — 2022 was not an easy year for The Walt Disney Company.

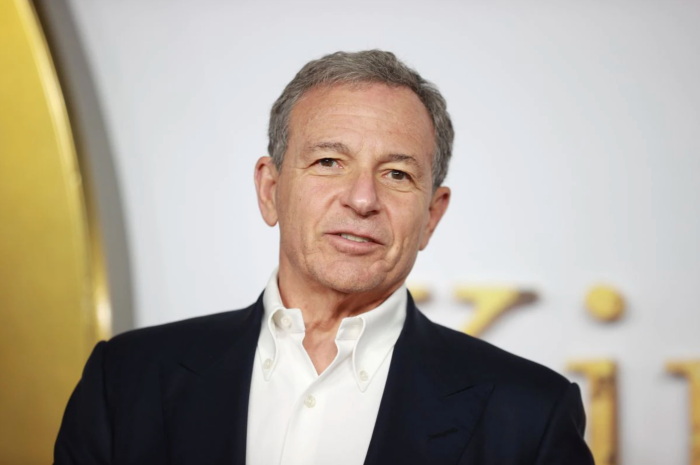

Although the parks were back open post-pandemic and plenty of new content was released in theaters and on Disney+, the company was suffering financially. It all came to a head when CEO Bob Chapek left the company after just two years and was replaced by his predecessor Bob Iger. The financial issues were reflected in the stock market…and the final results aren’t pretty.

According to the Wall Street Journal, Disney stock has officially had its worst year since 1974 — that’s nearly FIVE decades. How was that figured? Well, the price per share of DIS dropped 43% from January 1st to the end of December.

In 1974, Disney shares lost 54% of their value throughout the year, so it’s not quite as bad as it was back then, but this certainly doesn’t look good for the company. If you were holding out hope for the value of shares to rise dramatically when Bob Iger took the reigns again, you may be out of luck. The year’s highest value was $160.32 and the lowest was $84.07.

So what’s going on? Well, it seems as though people are waiting to see what happens next with Disney. It’s not uncommon for stock values to take a hit when a company brings back an old CEO, according to a study from MIT. And people might be holding out on their investments until they have proof that Bob Iger will make a positive change at Disney.

Basically, we’ll be watching Disney stock closely in 2023 to see what happens — it largely depends on Iger and the decisions he makes. It also doesn’t help that Disney was involved in a fair amount of political controversy in 2022. Some people have lost a bit of confidence in the company.

It’s a waiting game right now, but with shake-ups on the horizon, there are bound to be some changes…whether good or bad. It’s unusual for Disney stock to be stuck below $100 per share for so long — here’s to hoping it gets a rebound in 2023.

Click Here to See How Bob Iger’s Return Impacted Stock Values!

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

Do you own any Disney stock? Tell us in the comments!

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

TRENDING NOW

Being a Disney Adult certainly has its perks, but what happens when your fellow adults...

Let's talk about why 7 AM isn't going to matter anymore in Disney World real...

Trust us, you're not gonna want to miss these Disney deals on Amazon!

Come with us to try a BUNCH of tequila in Disney World!

EPCOT in Disney World is about to look very different in just a few days!

4 Disney Loungeflys you need if you're staying at Pop Century Resort at Disney World!

Don't go to Disney World in March until you know about these changes!

Let's talk about this refillable mug change at Disney World that Disney Fans are demanding!

A ton of Disney essentials are coming to ALDI next week!

Disney's 2025 Easter Collection has arrived at Target!

Target is coming through with an epic sale going on online right now!

Disney sakura plushes are now available on the Disney Store!

LEVEL99 is coming to Disney Springs! Wait, what is LEVEL99?

Consider which parks you want to rope drop before picking your Disney World hotel.

When you’re planning your Disney World trip, you have to figure out a lot of...

If you're heading to Disney World in 2025 and have never been or haven't been...

Get ready to sink your teeth into the best snacks in Magic Kingdom

We've made it our mission to hunt down some of the best values for drink...

This Hollywood Studios ride can be needlessly painful thanks to a lax rule.

After using the My Disney Experience app a LOT (like, a lot), there are a...