Disney has a lot of fires to put out.

While already facing the impending dissolution of the Reedy Creek Improvement District, the Company is also dealing with management changes thanks to the return of Bob Iger as CEO, along with a proxy battle for a seat on the Board of Directors. Amidst ALL of this, Disney must look to the future — well beyond 2023 — to a world where Hulu could become fully owned by Disney, and determine whether an earlier purchase of the Company can be made. But it might not be all that easy.

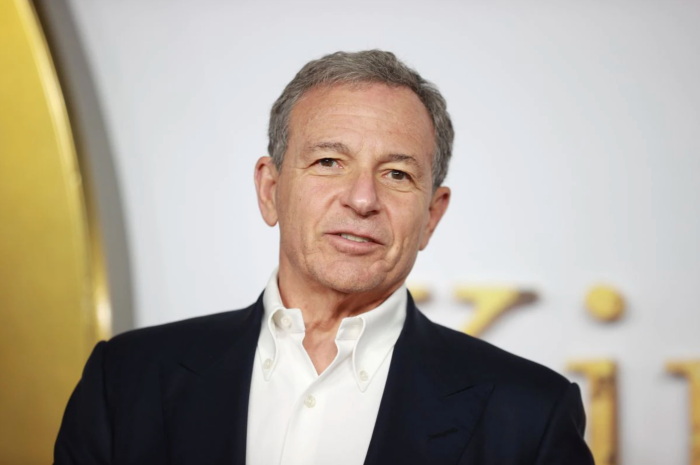

Iger Loves a Good Acquisition

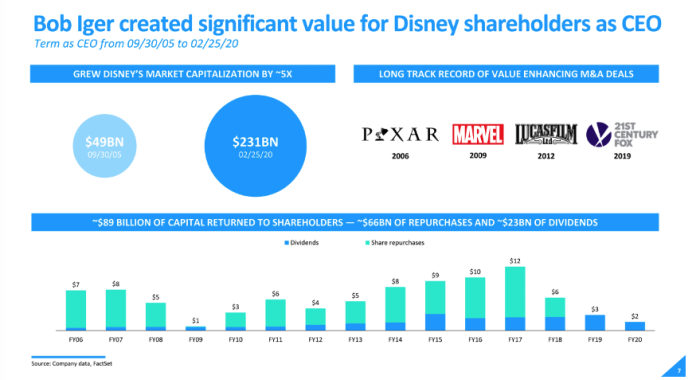

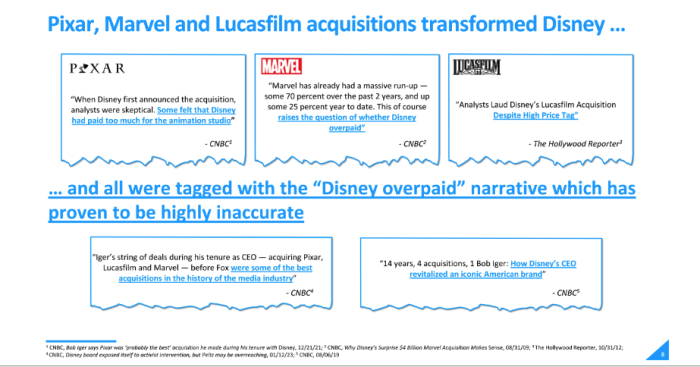

It’s undeniable that Bob Iger loves a good acquisition. During his original time as CEO, he oversaw and played a critical role in ensuring the acquisition of Pixar, Marvel, Lucasfilm and 21st Century Fox.

In fact, it’s something that Disney itself cites as having created “significant value for Disney shareholders.”

According to Disney, these acquisitions transformed Disney. And while they were generally tagged as being things that Disney “overpaid” for, Disney argues that narrative has been proven to be “highly inaccurate.”

We’ve seen the success of Marvel’s many movies and Disney+ shows, Star Wars’ own sequels and Disney+ shows, and Fox’s Avatar. So what could Iger’s next acquisition be? Hulu…maybe.

Hulu Might Be Next on Iger’s List

Disney already owns 67% of Hulu, and Comcast’s NBCUniversal owns the remaining amount. According to Yahoo, under the deal made back in 2019, Disney got “full operational control” of Hulu. And, as early as January 2024, “Comcast can require Disney to buy NBCUniversal’s interest in Hulu and Disney can require NBCUniversal to sell that interest to Disney for its fair market value at that future time.”

So, Disney could require Comcast to sell their interest in 2024, but Disney might want to push that acquisition to take place sooner rather than later!

Buying Hulu FAST was certainly on Chapek’s radar when he was CEO, as he once told CNBC that he’d love to own Comcast’s 33% stake in Hulu “tomorrow.” Chapek shared, “I would like nothing more than to come up with that solution for an early agreement.”

According to The Hollywood Reporter, Chapek noted why the Hulu acquisition was important, saying, “We’d have to have full ownership of Hulu to integrate it into Disney+.”

Chapek went on to note that Disney would “love to get to the endpoint earlier, but that obviously takes some level of propensity for the other party to have reasonable terms for us to get there.”

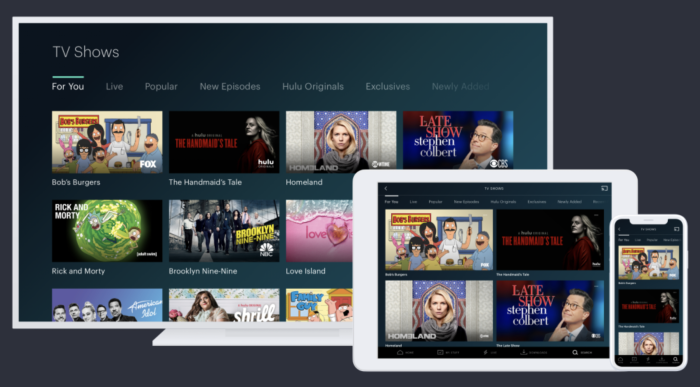

Chapek isn’t CEO anymore, so what is Iger’s view on all of this? Well, back in 2019 is when Disney made that deal to get full operational control of Hulu. At that point, Iger was still CEO of Disney and he shared that “Hulu represents the best of television, with its incredible array of award-winning original content, rich library of popular series and movies, and live TV offerings.” (Yahoo)

He also felt that by integrating Hulu into Disney’s direct-to-consumer business, they could “leverage the full power of The Walt Disney Company’s brands and creative engines to make the service even more compelling and a greater value for consumers.” (Yahoo)

So it seems Iger certainly values Hulu, what it brings to Disney, and what Disney brings to it too.

According to one insider cited to by Deadline, the deal, though questionable, is likely: “Iger likes deals, and he loves acquisitions, so it is only a matter of time for the next one, just watch.”

But it’s not just Disney that’s looking to make a deal (sooner rather than later) to get the rest of Hulu. Some activists are pushing for it too. According to CNBC, “Activist investor Dan Loeb is pushing Disney to accelerate a deal so it can fully integrate Hulu with Disney+, creating a ‘hard bundle’ that seamlessly allows users to view content from both services within one application.”

Considering the MASSIVE losses Disney has experienced with its direct-to-consumer business in recent quarters, the push to streamline content spending, and the focus on making streaming more profitable (specifically as it refers to Disney+), Disney may feel the pressure more strongly to follow investor desires to keep them happy while they figure out how to piece everything else together.

But Disney may also feel more restricted in shelling out the cash to make a Hulu acquisition happen. So it could go both ways!

Disney is losing BILLIONS on Disney+, where’s the money going?

But This Acquisition Might Not Be As Easy As Hoped

Despite some wanting a Hulu deal to happen ASAP, it might not be possible — or might not be as easy as Disney had hoped it would be. According to CNBC, even Chapek acknowledged (back in September of 2022) that “chances of an early deal are ‘less and less’ as 2024 approaches.”

Though Chapek said he wanted to make a deal, “that takes two parties to come up with something that is mutually agreeable.” And it seems the agreeable terms just haven’t been reached.

Comcast Struggles

For starters, Comcast isn’t making it easy. According to CNBC, the CEO of Comcast, Brian Roberts, has indicated that he too would like to own Hulu, that is if Disney decided to sell it.

Roberts shared, “Hulu is a phenomenal business…It has wonderful content and I believe if it was for sale, put up for sale, Comcast would be interested.”

And it might not just be Comcast that’s interested. According to Variety, Roberts said that he thinks others could be interested in buying Hulu if it were placed for sale.

From Comcast’s perspective, acquiring Hulu could be a great benefit. As Variety points out, it could enable Comcast to combine Hulu with Peacock and give “Comcast a more powerful play in the streaming wars.”

Is Disney interested in selling Hulu though? Several signs point to “no.” The Hollywood Reporter shared that Comcast reportedly approached Disney about buying Hulu from them as part of the 2019 Fox deal, but Disney was “not interested.”

What about the 2024 deadline and Comcast selling its interest in Hulu? Well, Roberts said that he’s open to discussing a sale of Comcast’s stake in Hulu before the 2024 date, but put the ball in Disney’s court to get conversations started.

But then there’s the issue of price

Let’s say Disney and Comcast do sit down for some serious conversations about Disney acquiring Comcast’s stake in Hulu before the 2024 date (or even for the 2024 deadline). How do you put a price on a streaming company and what do you value the shares at?

CNBC reports that Comcast CEO Brian Roberts shared that the best way to value Hulu would be to figure out what it would sell for in a theoretical auction. Roberts pointed out that there’s “never been a pure play, fabulous streaming service put on the market. So I don’t know that the public markets are the way to judge the value.”

Why? As Variety explains, Disney has already recorded Comcast’s interest in Hulu as being worth $8.6 billion (that was on July 2nd, 2022), implying a total value of $25.8 billion for Hulu.

But, as Roberts explained, if Hulu were to be sold in its entirety for an auction-style sale, it could sell for MORE than that. The higher value placed on Hulu, the more Comcast gets for its shares (and the more Disney has to pay for them!).

Remember, Disney has already guaranteed a sale price for Comcast’s interest in Hulu that represents a “minimum total equity value of Hulu at that time of $27.5 billion.” (Yahoo) That’s a floor price, but could Hulu actually be worth much more? Roberts seems to think it could, under the right circumstances.

But Chapek thought differently. Back in September of 2022 at least, CNBC reported that Chapek said the drop Netflix saw in its public valuation (following the loss of thousands of subscribers) should factor into the eventual sale price for Comcast’s shares in Hulu. That would, presumably, bring the price of the streaming service down.

The question also becomes are Roberts’ comments genuine (about buying Hulu and the public auction analysis) or is Roberts, as Variety puts it, “trolling Disney?” Could it all just be a bargaining ploy? Thus far, it’s not clear. But Disney will have to deal with it, one way or another.

And there’s the problem of timing

Aside from making the deal and settling on a price, there’s the issue of timing. On the one hand, getting the deal done quickly could help Disney move on from the matter and shift its focus to other things.

The Hollywood Reporter points out that Disney has been “focused on bringing its balance sheet back to where it was pre-pandemic, which has included buying back stock.” At that time Chapek was CEO and The Hollywood Reporter noted that he may be motivated to get the deal done “sooner, rather than later, to refocus on that.”

Plus, the sooner they buy out Hulu entirely, the sooner they could incorporate the service “fully” into their existing streaming services and really sell the whole thing as a package in the way they want to.

On the other hand, Chapek is no longer CEO, Iger has returned, Iger is working on some organizational changes, the Company is caught in the middle of a nasty proxy battle with Trian Group over Nelson Peltz’s desire to get a seat on the Board, and the battle regarding the Reedy Creek Improvement District is ongoing. So…maybe buying Comcast’s stake in Hulu falls to the bottom of an already-packed list.

But, it could be pushed to the front of the list again if activist investors put it there. For example, Nelson Peltz has said Disney either needs to buy Hulu, which would mean the Company would have a “debt load going forward for several years,” or Disney should just get out of the streaming business. (CNBC) Could Disney try to “appease” Peltz by making a quicker purchase to try and settle some of their disputes?

It likely all depends on what the biggest fire is. Would buying Hulu and taking on that large purchase NOW be a better deal than waiting until 2024 to then activate the option Disney has to require NBCUniversal to sell its interest (or have NBCUniversal force Disney to buy its interest)?

Would it be best to wait until 2024 to see how the streaming market develops so Disney has a better sense of what the fair market value is in light of their base price? There’s a lot that remains to be seen.

But future investor calls, shareholder meetings, and earnings reports could clue us into Disney’s plans. We’ll be eagerly awaiting news on these topics to see what happens. In the meantime, you can click here to see 4 important secrets you didn’t know about the Iger-Chapek conflict, and click here to see why some say Iger’s mistakes would have “killed any other CEO.”

Click here for a full timeline for Chapek’s exit, Iger’s return, and Disney’s corporate battles

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

What do you think about Disney acquiring Hulu? Tell us in the comments.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

TRENDING NOW

A LOT is happening in Disney World in 2025.

Two NEW Disney additions are coming this December and we can't wait to experience them...

We're taking a closer look at the NEW hotel rooms coming to the Walt Disney...

There's a HUGE sale happening at Target for the next few days that you CANNOT...

Pool hopping is no longer, which means you may have to make a tough decision...

Disney Loungefly wallets, backpacks, and crossbody bags are seriously discounted on Amazon right now!

Let's talk about these huge attractions that Disney World has seemingly abandoned!

We've waited a whole year to see Disney World's transformation for the holidays, and it's...

Why wait to buy a Loungefly bag at Disney? We found 7 that are cheaper...

There's some NEW airport technology from American Airlines that we think you're going to like!

Sweater weather is back which means it's time to get some new Disney sweatshirts!

SET YOUR ALARMS! Disney just announced a NEW Starbucks tumbler is coming soon!

Disney just revealed the full list of Lightning Lane prices for Thanksgiving day.

Three new holiday treats have arrived in Disney World!

We tried out the newest treats at Blizzard Beach -- see our thoughts here!

I'm taking you along to one of EPCOT's most popular quick service spots!

If you're going to be staying at a Disney World hotel in December, you're in...

The exception to the standby line rule for Tiana's Bayou Adventure is during the exclusive...

We're trying a new snack at Amorette's Patisserie!

Let's go over some of the things you say are 100% worth buying at Disney...