Bob Iger returned as Disney’s CEO last November, and he’s made some major changes in the short time that he’s been back. But could a proxy battle with an investor group mean even MORE changes on the horizon?

Nelson Peltz is an activist investor who has taken a keen interest in The Walt Disney Company. Peltz has some strong opinions about the direction of the company, and he is demanding a seat on the company’s board so that he can get to work making those changes. But how likely is Peltz to succeed, and what could change if he does? We’re diving into all the details here.

Before we get to all the details, here’s a quick look at what’s happening with Nelson Peltz, the Trian Group, and The Walt Disney Company’s Board of Directors.

What’s Going On?

Disney is currently engaged in a proxy battle against Nelson Peltz and the Trian Partners. If that statement means nothing to you, don’t worry — we can break down exactly what it means.

Nelson Peltz is the CEO of the Trian Partners, which is an activist investor group. That means that the Train Partners invest heavily in certain companies and then become actively engaged with how those companies are functioning and growing. Currently, Trian Partners own about 9.4 million shares of Disney, which is valued at about $900 million (CNBC).

The Trian Partners want their CEO, Nelson Peltz, to have a seat on Disney’s Board of Directors so that Peltz can have a vote when it comes to major decisions for the company. Peltz and the Trian Partners have some strong opinions on certain changes that Disney should make, and having a seat on the Board would make it more likely that those changes will happen.

The problem is that Disney has not offered Peltz a seat on the Board. Now, Peltz is petitioning Disney’s shareholders to vote him onto the Board. Peltz has released a presentation detailing why he should be voted onto the Board, and Disney has responded by saying that shareholders should NOT vote for Peltz but should instead support the candidates that the current Board has suggested.

The decision will be made at Disney’s next shareholder meeting, which usually takes place in March (although an exact date has not yet been announced). If the shareholders vote Peltz in, he’ll be given a seat on the Board. If they don’t, Peltz will not be allowed to sit on the Board. It’s all up to the shareholders, so that’s who Peltz and Disney are both trying to win over right now.

Get more details about the proxy battle here.

Who Is Nelson Peltz?

So who exactly IS Nelson Peltz? We touched on this briefly when we said that he is the CEO of Trian Partners, but you need to know a bit more about the man behind this proxy battle.

Peltz doesn’t work for Disney (that’s what he’s working toward now). He has actually held quite a few positions in the past, many of which were on boards at various companies. Peltz is currently a director of Unilever PLC and Madison Square Garden Sports Corp. He’s served as a director of Janus Henderson Group plc; Invesco Ltd.; The Procter & Gamble Company; Sysco Corporation; Legg Mason, Inc.; Mondelēz International, Inc.; MSG Networks Inc.; Ingersoll-Rand plc; and H. J. Heinz Company. So Peltz has been on a LOT of Boards of Directors in the past.

He’s also been the CEO of Triarc Companies, which owned Arby’s and Snapple at the time. Peltz says he has extensive business and investor experience, particularly when it comes to consumer products.

Whether or not that particular expertise is right for Disney is currently up for debate. In an interview with Peltz, CNBC challenged him and asked what Peltz really brings to the Board if he doesn’t have any media experience. Peltz responded by saying, “Have they shown that they have a lot of media experience? Look at the numbers!” He also pointed out that Disney is “a lot more than a media company” and has a large investment in consumer products as well as media entertainment.

Learn more about Nelson Peltz and the Trian Group here.

Peltz’s Goals for Disney

As an activist investor group, Trian’s goal is to convince companies to adopt changes that will increase the value of that company’s shares. (As the group owns 9.4 million shares of Disney, they could profit a lot if those shares increase in value.) The group invests in public companies and then advocates for changes. Nelson Peltz is now focusing on Disney and the changes that he believes will make Disney shares more valuable.

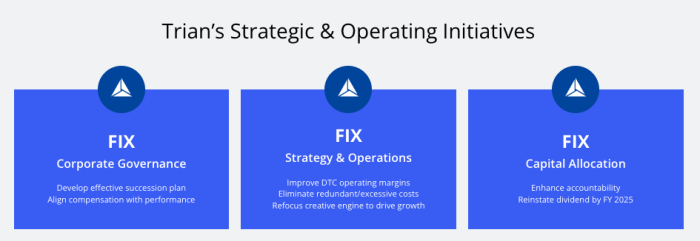

Peltz wants a seat on Disney’s Board of Directors so that he can be more involved in the decisions made at the company. Here’s a quick breakdown of what Peltz wants to fix at Disney:

Peltz says the main problems that Disney is facing right now are CEO succession, poor financial strategy (especially when it comes to streaming), and not enough accountability with capital allocation. Peltz emphasized in a presentation that he feels Disney is over-earning at the theme parks in order to make up for losses in streaming, and he feels this is an irresponsible strategy.

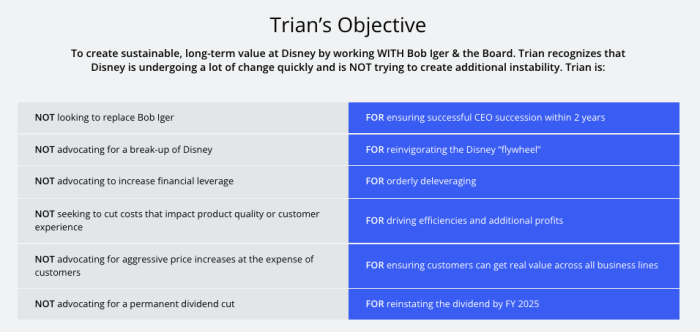

There’s a chart listing more of Peltz’s objectives on the company’s site about Disney:

Note that Peltz does NOT want to oust Bob Iger as Disney’s CEO. Although he was apparently against Iger’s return, he has recently stated multiple times that it is not his goal to get Iger out.

Peltz takes particular issue with the company’s acquisition of Fox back in 2019. He claims that Disney “materially overpaid” for the Fox assets, which upset the company’s balance books. Many of the current Board members were on the Board when Disney bought Fox, which likely contributes to Peltz’s belief that change is required at the company.

Peltz’s presentation states that “there are still several current directors and members of management who oversaw and approved some of Disney’s worst corporate governance and strategic failures, including overpaying for the Fox acquisition, the expanding streaming losses, and ‘over-the-top’ compensation packages granted to Bob Iger.”

In short, Peltz sees problems with how Disney is being run, and he believes those issues are affecting the company’s value. He wants to be on the Board in order to correct the problems, particularly those related to CEO succession and streaming.

Nelson Peltz’s History with Corporate Takeovers

So how likely is it that Peltz will win this proxy battle? If you look at his history with these situations, the odds are almost 50-50. In 2006 he challenged the board at The H. J. Heinz Company and won two seats, according to CNN. He served on that board for about seven years, from 2006 until 2013.

In 2015, Peltz challenged the board at DuPont, this time battling for four board seats. Peltz lost the proxy battle and was not appointed to the board (Reuters). However, Peltz continued to work with DuPont after the loss. According to Trian’s website, “Nelson and Trian worked successfully with DuPont’s CEO Ed Breen who was appointed as CEO following the proxy contest with Trian.”

Most recently, Peltz and the Trian Partners went up against Procter & Gamble, and although the messy proxy battle yielded mixed results (with both sides claiming victory at different points), Peltz was ultimately granted a seat on the board. The Wall Street Journal reported that this was the “biggest and most expensive proxy battle ever fought” and that it “essentially finished with a tie.”

The final results showed that Peltz actually lost the vote (by almost 500,000 of the nearly 2 billion votes cast), but because a significant portion of shareholders supported Peltz getting a seat on the board, P&G decided to appoint him one anyway. He served on that board from March 2018 to October 2021.

In total, Peltz has served on 11 boards, most of which he did not have to fight to claim a seat.

Trian’s website states the following about these contests: “In all three proxy contests, we heard similar rhetoric to that which Disney and its advisors are using today to oppose Nelson’s election to the Disney Board. However, each company’s board and management changed their assessments of Trian and Nelson after the proxy contests, when we began to work with them to enhance shareholder value.”

Disney’s Current Board of Directors

We know that Peltz and the Trian Partners have some experience when it comes to proxy contests, which puts them at a bit of an advantage compared to Disney. The New York Times states that “Disney has not faced a sustained shareholder battle since 2004, when Roy E. Disney, a nephew of Walt Disney, led a successful drive to oust Michael D. Eisner as Disney’s chief executive.” It’s possible that Disney’s proxy armor is a little rusty.

Currently, there are 12 people on Disney’s Board of Directors. Susan E. Arnold — the Chairman of the Board — will be leaving soon due to a 15-year limit for board membership. Mark G. Parker (current CEO of Nike) will take her place as Chairman when she leaves.

Parker has stated that his top priority is the issue of succession for Disney’s CEO. He said, “It is the top priority of mine and the Board’s to identify and prepare a successful CEO successor, and that process has already begun.” Parker will chair “a newly created Succession Planning Committee of the Board, which will advise the Board on CEO succession planning, including review of internal and external candidates.”

The Disney Board has its own priorities right now, and they are not supportive of Peltz joining the Board. They have urged shareholders to vote for the Board’s current nominees instead.

Disney has also defended its recent financial decisions, stating that the company “has had a long-term track record of financial and creative success” and has “built on the ability to leverage its rich intellectual property and unparalleled storytelling across its many businesses, from theatrical, streaming, and linear broadcast to parks and resorts.”

In a recent SEC filing, Disney made the following statements:

- “The current Disney Board is the right Board for shareholders.”

- “Nelson Peltz does not understand Disney’s businesses and lacks the skills and experience to assist the Board in delivering shareholder value in a rapidly shifting media ecosystem.”

- “Peltz has no track record in large cap media or tech, no solutions to offer for the evolving media landscape and if MSG Sports is his training ground, it has not been a good one.”

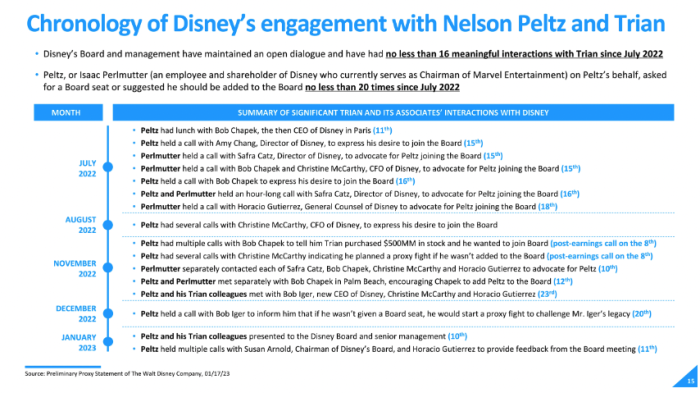

Note that Disney has worked with Peltz before, but not in an official capacity. Peltz met with Bob Chapek when Chapek was still Disney’s CEO, and he met with Bob Iger once Iger returned to the position. He was on several calls with the CEOs and other executives at Disney, petitioning for a seat on the board and offering advice about what was happening at the company. A timeline released by Disney also shows he has spoken with the former chair of the Disney Board — Susan Arnold — recently.

In January 2023, Disney informed Peltz of their decision not to place him on the Board, and they expressed their desire to “find a path for constructive engagement that would avert a proxy contest.” They also offered Peltz the ability to get some non-public information about Disney and meet with “management and the Board quarterly to discuss strategy and other issues so that they could establish some mutual understanding about the Company’s business and strategy.”

Learn more about Mark Parker here.

What a Victory for Peltz Would Mean

So what would really happen at Disney if Peltz were to win this proxy battle? Peltz has identified several changes that he would like to see, and some of those could affect the parks.

Peltz noted in his presentation that “nickel and diming” guests at the Disney theme parks is ultimately bad for Disney, as it could “put the brand value” at risk. He is likely referring to recent price increases, such as the introduction of Genie+, ticket price increases, and increased use of surge pricing.

Peltz also states in his presentation that employees are “a crucial component” of positive guest experiences at Disney Parks. He addressed Cast Member wages, which is a hot topic at Disney right now. Unions are pushing for Disney to raise minimum wage to $18 per hour, and Disney has stated that it presented a “meaningful offer” that provided a path to $20 per hour wages for many full-time Cast Members. However, unions argued that their members need the pay raises sooner than Disney is currently proposing.

Other changes that Peltz would like to make include those listed above in the section about Peltz’s goals for Disney. In Peltz’s presentation, he emphasizes the importance of finding a good successor for Bob Iger, who is only on a 2-year contract wit Disney right now. Iger has previously struggled with finding a replacement for CEO, so this issue would be one of the main priorities that Peltz is concerned about.

The Trian group has stated that “Executive Compensation Must be Aligned with Performance,” indicating that they would adjust executive employees’ salaries to be more contingent on their performance at the company.

Another complaint Peltz has leveled against Disney is the company’s streaming strategy, although there aren’t many solutions proposed in his presentation.

Want to learn more about Nelson Peltz and his proxy battle with Disney? Check out these posts:

- Activist Group Believes Disney Has “Lost Its Way” and Pushes for Board Changes

- Who Is Nelson Peltz and Why Do People Care What He Says About Disney?

- The Big Disney Parks Changes that Activist Investors Are Pushing

- Disney Pushes Back Against Activist Investor and Defends CEO Bob Iger

We’ll continue to follow this story, so stay tuned to DFB for more updates!

Click here to learn about 3 nasty surprises waiting for Disney CEO Bob Iger in 2023.

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

What do you think of Peltz’s proxy battle against Disney? Let us know in the comments.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

TRENDING NOW

Flights are getting delayed today!

Get that last-minute holiday shopping done now!

A brand-new Stanley collection has just landed at Target!

The owners of Gideon's Bakehouse are opening a new concept in Orlando and we've got...

Keep these laws in mind when you make your next Disney World trip!

This special Magic Kingdom parade is changing tomorrow and we have all the details.

Watch out for this TSA PreCheck scam before you travel!

Now is a great time to grab those last-minute gifts from Amazon since some really...

Shrinkflation strikes again.

This Disneyland attraction will close soon for refurbishment.

These are some of the most wholesome things we've overheard in Disney World!

There's nothing like riding on the Skyliner when you're at Disney World, and if you're...

An iconic Disney celebrity is coming to Orlando SOON and we bet he's making a...

Disney's new timeline gives us a better idea when this EPCOT icon will be up-and-running...

A NEW sweet treat has landed at The Cake Bake Shop and we're bringing you...

Do you really need to purchase a MagicBand to vacation at Disney World? Let's go...

It's about to get real saucy up in here.

Let's talk about what the Loungefly Organizer is and why everyone is grabbing one for...

Buckle up! Hollywood Studios is changing in the new year!

In case you missed it, Disney confirmed that 2 restaurants in Hollywood Studios are permanently...