February 8th might sound like a random day to you, but it’s a critical day that could bring some HUGE announcements from the Walt Disney Company.

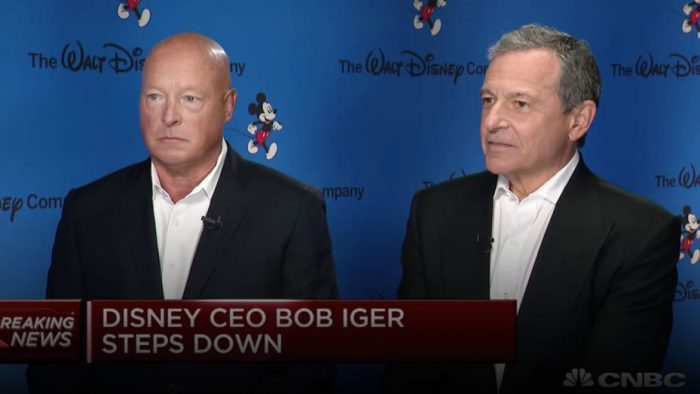

Why? February 8th is the first quarterly earnings call since Bob Iger returned to the Company as CEO. And it’s the first earnings call since the controversial one that took place in November of 2022 that ultimately led to Bob Chapek’s ouster from Disney. In other words, there’s a lot at stake. Stock values have fluctuated since Iger’s return and shareholders will likely be eager to know just what financial state the company is in right now (and how much Iger has done to change things). But there’s more on the potential agenda too.

“How important can an earnings call really be?” you might be asking yourself. And the answer is: VERY important. Back in late 2022, Bob Chapek was removed just days after the earnings report and earnings call on November 8th. Though various things had already impacted some Disney executives’ confidence in Chapek (including his handling of the Scarlett Johansson situation, the way he responded to the situation surrounding Florida’s Parental Rights in Education bill — what critics called “Don’t Say Gay,” and other matters), it was the final earnings call of 2022 that really served as the final straw.

During that earnings call, Disney revealed a $1.5 billion loss in streaming — no small number. Following that reveal, Disney stock values dropped and CNBC host Jim Cramer even called for Chapek’s firing (Financial Times). He said Chapek was “incapable of running a fantastic company.” Some pointed out that it wasn’t just the loss in streaming that caused an issue. Instead, it was that loss coupled with Chapek’s tone in addressing the earnings report, which some called “happy-go-lucky” (New York Times). Certain investors and people within Disney were shocked at Chapek’s “tone deaf” demeanor or “inappropriately sunny” attitude during the call (where he did things like emphasize a positive response to smaller events like Mickey’s Not-So-Scary Halloween party in Disney World, amid huge losses elsewhere).

And it didn’t help that just days after the report, Chapek announced potential job cuts, saying “We are going to have to make tough and uncomfortable decisions.” Suffice it to say, by November 20th Chapek was out and Iger was back. So earnings calls and how CEOs handle them truly CAN be critical.

And this earnings call/report comes just as Disney faces a massive battle with activist investor Nelson Peltz and his Trian Partners organization. And it’s no joke — one reporter even called the situation Bob Iger’s “fight for the future of Disney.” Peltz has already launched his proxy battle and is urging shareholders to essentially fire an existing Board member and elect Peltz in his place. Disney has emphatically stated that they do NOT support Peltz’s attempt to get a seat on the Board.

We won’t get a resolution to this fight at the earnings call though. Instead, it won’t be until Disney’s annual shareholder meeting in early April that we’ll finally get to see whether Peltz has won or Disney has managed to keep the activist investor off of their Board. But the earnings call will be critical for this battle for other reasons. Nelson Peltz and Trian Partners will undoubtedly be waiting eagerly for Disney’s report, ready to dissect it and see how it fits their platform.

Will it only further his criticism of Disney’s actions? Will it fuel his arguments about Disney exercising a poor financial strategy (particularly when it comes to streaming)? A “bad” report or a report that shows more substantial losses in streaming could be just what Peltz needs to convince more shareholders to vote for him. But a “good” report that potentially shows a level of success Peltz would not have expected could strengthen the position of the Board and help them convince shareholders that there is no need to add Peltz to their group.

As Michael Nathanson from MoffettNathanson shared, “It has to be an impactful, meaningful, tone-setting, agenda-changing day.” (The New York Times) Another analyst, Jessica Reif Ehrlich from BofA Securities shared, “I don’t know that we’re going to see answers to everything, but Iger’s overall messaging is going to be critical.”

If Iger really wants to please investors and show them that the Walt Disney Company is headed in the “right” direction, some analysts have indicated that Iger will need to lay out plans in two big areas during the call:

1 — News on Restructuring The Streaming Business

First, many analysts are eagerly awaiting news about the restructuring of Disney’s streaming business. In fact, this is one of the key things Iger has been charged to do.

In a report Disney filed with the SEC following Iger’s return, they made it clear by sharing, “As contemplated by the leadership change announcement, we anticipate that within the coming months, Mr. Iger will initiate organizational and operating changes within the Company to address the Board’s goals. While the plans are in early stages, changes in our structure and operations, including within DMED (and including possibly our distribution approach and the businesses/distribution platforms selected for the initial distribution of content), can be expected. The restructuring and change in business strategy, once determined, could result in impairment charges.”

DMED is the Disney Media and Entertainment Division. It was a division heavily emphasized during Chapek’s time at Disney and led by Chapek’s right-hand man, Kareem Daniel. DMED reportedly created a lot of strife between creative leaders and executives in DMED. That is because it essentially centralized budgeting decisions for content and distribution. Some executives felt that they were being stripped of their power and further changes empowering DMED would have only made the situation worse.

Immediately upon Iger’s return as CEO, it was announced that Kareem Daniel would be leaving Disney, so right away the changes seemed to begin.

And Iger swiftly sent a note to Disney employees saying that he had asked some executives to work together “on the design of a new structure that puts more decision-making back in the hands of our creative teams and rationalizes costs, and this will necessitate a reorganization of Disney Media & Entertainment Distribution.”

But since that time, we really haven’t heard any big news about DMED and how Disney plans to restructure things. In a letter to shareholders, Disney did note that one of Iger’s key priorities is “driving profitability in streaming,” but just what exactly are they doing to (1) make streaming profitable, and (2) restructure DMED? How big are the streaming losses for this most recent quarter? We will soon find out.

According to some analysts, Iger really needs to present a leadership plan and realistic timeline to profitability to calm shareholder and investor fears. As The New York Times points out, traditional television profits are declining faster than streaming losses can moderate. Will Disney+ be able to hit its goal of being profitable by Fiscal Year 2024, or will Iger push that date? This earnings call could provide some big answers.

Disney losing billions on Disney+ — where’s the money going?

2 — Cost-Cutting Measures and Layoffs

Another area that could see major updates is staffing, cost-cutting measures, and layoffs. As we mentioned, back in November of 2022 Bob Chapek revealed that Disney would be instituting a “targeting hiring freeze.” He also mentioned that job cuts could be part of changes made at Disney saying, “We do anticipate some staff reductions as part of this review.”

This was not the first time cost-cutting measures had been mentioned though. At the earnings call in November, Disney’s CFO Christine McCarthy said that Disney was “actively evaluating [its] cost base…and…looking for meaningful efficiencies.” Those changes were meant to “provide some near-term savings” as well as “drive longer-term structural benefits.”

Again, this was something first mentioned months ago. Iger later confirmed that he planned to continue with the hiring freeze, but we haven’t heard much about it since. But considering the big losses seen in streaming, cost-cutting measures of some kind could be necessary to satisfy investors and reassure them that Disney is taking steps to make sure it is in a good place financially.

Additionally, Disney is currently caught in the middle of a battle with labor unions representing many Cast Members at Walt Disney World. In early February 2023, Cast Members actually voted to REJECT the contract offer Disney had made addressing future wage increases. Disney has pointed out that its offer would have provided 30,000 Cast Members with a pay increase that amounted to “a nearly 10% average” and would have been retroactive back to October 1st.

Disney’s offer would have gradually increased starting wages at Walt Disney World to $20 per hour over the next five years. But unions have argued that Cast Members need bigger raises sooner because of cost-of-living increases in Central Florida. The unions previously demanded an immediate minimum wage of $18 per hour for the Cast Members they represent. Since Cast Members recently rejected Disney’s most recent offer, the unions will be asking Disney to resume negotiations.

How Disney will address this entire situation remains to be seen.

To ease investor worries, Iger may need to lay out a plan in terms of cost-cutting measures, or at least provide an update on what Disney intends to do.

Click here to see why executive leadership changes could be on the way at Disney

Those are 2 big areas Iger may need to address during the upcoming earnings call to satisfy investors. But just what questions the Company will take and what responses they’ll provide remains to be seen.

We’ll be watching for the release of the earnings report and will be sure to share details about the report and call with you, so stay tuned for our coverage.

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

What do you think will be revealed at the earnings call? Tell us in the comments!

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

When Mister Iger will change something in a right way, think about the head of a fish, they the problem starts. Reduce the costs of the big head of the company.

Reduce the amount of manager. It’s no needed to have tons of manager for the same shit. Let work the departments together, so that all departments have the same knowledge and guests don’t hear various answer for one question.

Don’t make it more pricey for the people to can make vaccinations at Disney. Without guests the company looses money.

And don’t forget the part of Annual Passholder they are not the unworthy Part, they are loyal in all times.

Go back to the times before the pandemic, that was a better time for Disney, Employees and Guests was more happy.

Get rid of reservation requirement and bring back fast pass system. We are senior citizens who winter near Disney World and annual pass holders. We enjoyed impromptu visits to the parks just to enjoy the environment and securing a fast pass every now and then. Currently this is not worth the trouble so we fine other entertainment options.