Disney has been in the middle of a heated WAR.

No, we’re not talking about the battle with Florida Governor Ron DeSantis and the situation with Disney’s Reedy Creek District. And no we’re not talking about those Park Pass lawsuits or the replacement of Bob Chapek with Bob Iger. And we’re not even talking about the battle to acquire Hulu. So what’s going on here? And just what war did Iger win before it truly began? Let’s dive in!

One Name: Nelson Peltz

This war has entirely to do with Nelson Peltz. Who is that and why do people care about what he says? Well, we’ve got a FULL post that does a deep dive into the topic, but here’s a quick breakdown.

Activist investor Nelson Peltz and Trian Partners (Peltz is CEO of Trian Partners) began pushing for Peltz to have a seat on Disney’s Board of Directors quite some time ago (before Peltz was even an investor in Disney). Peltz shared quite a few criticisms of the Walt Disney Company.

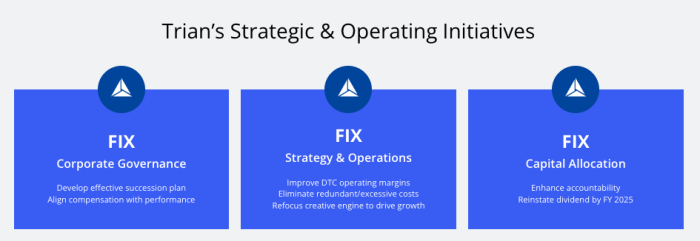

Some of the main problems he identified were: CEO succession, poor financial strategy (especially when it comes to streaming), and not enough accountability with capital allocation. Peltz emphasized in a presentation that he felt Disney was over-earning at the theme parks to make up for losses in streaming, and he felt this was an irresponsible strategy.

Disney, however, pushed back, insisting that Peltz wasn’t qualified for a seat on the Board and really hadn’t made constructive suggestions for changes. Thus began the proxy battle where Peltz and Trian Partners reached out to Disney shareholders, encouraging them to basically fire an existing Board member and vote for Peltz to get a seat instead (against Disney’s recommendation).

The war had only just begun. Things were really going to heat up at the shareholder meeting, or really just before the shareholder meeting (since shareholder votes would be due just before the meeting on April 3rd, 2023).

All signs pointed to a monumental war. It was a situation that one reporter called Bob Iger’s “fight for the future of Disney.” But what happened next was…surprising.

The Earnings Call

On February 8th, 2023, Disney released its earnings report for the first quarter of the 2023 fiscal year and held an earnings call right after the report was released. We expected that this report and call would become key to the Peltz/Disney battle, either fueling Peltz’s battle or perhaps weakening his position.

There was some good news and some bad news from Disney’s first quarterly earnings report for fiscal year 2023. On the good side, the parks reported some great revenue figures (again) thanks to increased guest spending. Disney also revealed that a new Avatar experience will be coming to Disneyland, sequels are in the works for 3 hit Disney films, and Iger is truly focused on making streaming profitable.

On the bad side, Disney+ reported a small drop in subscribers and direct-to-consumer reported more operating losses.

In other big news, Iger announced a massive restructuring of the Company that will change the DMED structure put in place with Chapek (that created a divide between the creative side of things and decisions made about the distribution of creative works).

Iger also announced steps that will be taken to cut BILLIONS of dollars in spending at the Company, part of which will include 7,000 job cuts. And he shared that there is an intent to seek Board approval to reinstate the dividend. It was quite the call with some HUGE announcements throughout.

Click here to see a detailed overview of the biggest news from the report and call

Iger’s Comments on Peltz

The earnings call ended and the Disney Company continued on its way, with the Peltz battle looming in the background. Iger later appeared on an interview with CNBC’s Squawk on the Street where he discussed a variety of topics (like how he plans to stay for just 2 years), including Peltz.

David Faber asked Iger why Iger wouldn’t just put Peltz on the Board, and Iger said that it wasn’t a question of “why not” but “why.” He went on to discuss Disney’s existing Board, their qualifications, and why they’re best suited to help Disney’s shareholders; and noted why there’s no need to add Peltz.

.@Disney CEO Bob Iger discusses Trian Partners CEO Nelson Peltz's efforts to join $DIS board and the ensuing proxy fight. $DIS pic.twitter.com/LsvvacrqBF

— Squawk on the Street (@SquawkStreet) February 9, 2023

The SUDDEN Change

Just moments later, CNBC shared a video where Peltz called in to say that the proxy fight is OVER.

According to Peltz, “this was a great win for all the shareholders.” He said that the management at Disney now plans to do everything Peltz’s group wanted them to do. He said they “wish the very best to Bob” and the Board, and noted that they will be watching and rooting for them.

Trian Partners founder Nelson Peltz calls into the show to tell @jimcramer that the $DIS proxy fight is over. pic.twitter.com/P3X0SJLDZX

— Squawk on the Street (@SquawkStreet) February 9, 2023

In a statement, Disney’s Board shared their positive view of this outcome. “We are pleased that our board and management can remain focused without the distraction of a proxy contest, and we have tremendous faith in Bob Iger’s leadership and the transformative vision for Disney’s future,” they said.

Perhaps key to this all was Iger’s way of handling the earnings report and call. As the New York Times shares, Iger “came across as tough, cleareyed and decisive,” but also threw some “candy” to Disney fans with news of the movie sequels. The results have been a far cry from the last earnings call, which led to Chapek’s ouster.

Oh, and let’s not forget that a proxy battle is expensive. According to one securities filing, the battle would cost Trian about $25 MILLION. That’s a lot to pay when it seems like many of Peltz’s points have already been addressed. Patrick Gadson (co-chair of shareholder activism at Vinson & Elkins) pointed out, “Part of activism is always realizing that the aim of an activist is not to get board seats…They don’t get paid to get board seats. They make money by, when it all boils down to it, stock price appreciation.”

What Now?

Well, Peltz said that they would be watching and we expect that will be true. Trian Partners did acquire a substantial amount of shares in the Walt Disney Company, and we expect they could have much more to say in the future if things at Disney don’t go quite as they’d like.

Plus, Disney has a LOT of work to do to meet the goals it has set for itself when it comes to profitability with streaming, cutting billions in spending, and ensuring that the reorganization plays out as they hope it will.

And there are more challenges on the way. How will Disney handle the Hulu situation and the date (that is quickly approaching) on which they may acquire Comcast’s remaining interest (or perhaps choose to sell their own interest)? How will Disney deal with dropping profits from more linear television sources?

How will Disney handle Ike Perlmutter (chairman of Marvel Entertainment), who championed Peltz’s bid for a seat on the Board from within Disney? With massive changes on the way for the Reedy Creek District, how could that impact the Company?

Despite the challenges that might await Disney in the coming months and years, some analysts have looked favorably at the Company and raised their outlook on Disney’s shares. The road ahead may be long and full of twists and turns, but it seems like one major battle may be over for Disney…at least, for now.

Click here to see Iger’s thoughts on Disney’s theme park pricing

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

What do you think about this situation and how it ended? Tell us in the comments.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

More movie sequels? Great! What happened to imagineers being imaginative and coming up with new ideas??? Spend that chunk of change on creating and QUICKLY adding more rides!!!