When you think of the Disney parks what comes to mind? Maybe it’s an image of Cinderella Castle, hours-long lines for Star Wars: Rise of the Resistance, or money flying out of your bank account as you pay for that hotel stay. 😂 But how are the Disney parks ACTUALLY doing financially?

We’ve seen some interesting financial reports on the parks in recent years. Though the parks have often been the highlight of Disney’s earnings call (bringing in some BIG bucks in prior years), we have seen recent reports showing disappointing results in Disney’s Florida parks (which it has partially blamed on the Star Wars Hotel). So what’s the latest update? We’ve got it right here for you.

On February 7th, Disney released its earnings report and held its earnings call on the first quarter of fiscal year 2024. That gave us a better idea of how the Company has been doing financially over the last few months, and things are interesting when it comes to the Disney parks (and Disney Experiences in general).

In an interview with CNBC before the earnings call, Iger stated, “The combination of [global parks] with the domestic parks, whose business is, I think, more than twice what it was before the pandemic, is just an extraordinary business for us.” A lot of the success came from the global parks, which saw higher revenue due to guests spending more in the parks and on average higher ticket prices. They also saw a growth in attendance. The opening of World of Frozen at Hong Kong Disneyland and Zootopia at Shanghai Disney Resort helped with the success.

As we noted above, recent reports have shown lower financial results at the Florida theme parks, and that is echoed in the 2024 Q1 Earnings Report, which shows that revenue has dropped at the domestic parks and hotels. Disney attributes these to lower attendance at Disney World and higher costs because of inflation. Though guests spent more on tickets, this was offset by lower average rates of hotel rooms.

In Disneyland, the results were similar to previous quarters. There was attendance growth, higher ticket prices, and higher costs within the parks due to inflation, all of which impacted the growth. However, this revenue growth was offset by the increase in costs at the resort.

Iger said that every Disney park was profitable this quarter, and Disney has big plans for their theme parks: “We have so many untapped stories just waiting to be brought to life in our parks across the globe.”

In terms of Disney Cruise Line, there was much higher success and it offset the lower results in the two domestic parks. There was an increase in ticket prices and more days added to cruise itineraries. While there were higher costs, it wasn’t as much of an impact here as it was for the parks.

Disney has some interesting things happening in its theme parks. Its international parks have recently become home to some BIG new things, like the World of Frozen in Hong Kong Disneyland. And some more large expansions will open soon, like Fantasy Springs in Tokyo Disney Resort.

On the domestic side, however, plans have been far less concrete. Disney is working on its Disneyland Forward project for the West Coast and has announced $1.9 billion expansion plans without concrete details about what exactly would be coming to the parks.

Disney has also discussed potential expansion/change plans for Magic Kingdom and Disney’s Animal Kingdom, but these have all simply been “Blue Sky” concepts — a.k.a. they are ideas of what could happen, but nothing has been officially confirmed yet.

As a whole, Disney has said that they plan to invest about $60 billion in their experiences over the next 10 years, but this plan to “turbocharge” growth within Disney’s theme parks won’t really take place until the second half of that 10-year plan.

During the recent Earnings Call, Disney said that 70% of that $60 billion investment is earmarked for “incremental capacity-expanding investment,” and every Disney theme park is going to get something new.

With Universal poised to open its brand new Epic Universe theme park in 2025, however, some expect Disney to announce a 5th park soon in an attempt to compete. Will it all be too little too late? Only time will tell.

We’re keeping a close eye on all of the news from Disney’s earnings call so stay tuned for more!

Click here to see what experts are saying about Disney announcing a 5th park

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

WE KNOW DISNEY.

YOU CAN, TOO.

Oh boy, planning a Disney trip can be quite the adventure, and we totally get it! But fear not, dear friends, we compiled EVERYTHING you need (and the things to avoid!) to plan the ULTIMATE Disney vacation.

Whether you're a rookie or a seasoned pro, our insider tips and tricks will have you exploring the parks like never before. So come along with us, and get planning your most magical vacation ever!

What do you think about the latest Disney theme park financial numbers? Tell us in the comments.

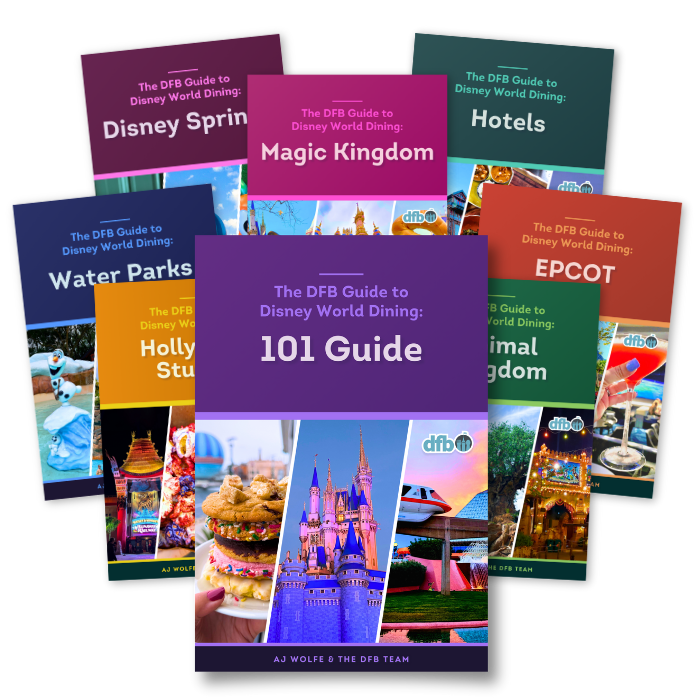

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

If they are making so much money, where’s the reinvestment in WDW? Actual NEW rides under construction? Zero! We were at Haunted Mansion a month ago and the wall paper was falling off the portrait room. Who would buy DVC or not sell their DVC when the company investment is flat at a time Universal is adding a whole new park. WDW is dying. If it sounds like I’m frustrated, I am. As a DVC member, I feel like I’ve wasted my investment.

Prices for Disney Cruises are high, high, high to compensate for the parks as guests shifted their vacation time with Disney to the waters.

Lower attendance at Disney World?

You can’t prove that by tracking the crowds at all of the parts in 2023.

There is rarely a slow day.

Hi A J,

Per your report above, it appears that new attractions and lands will lead to increased revenue and profitability. Tokyo Disney grew due to the opening of Zootopia, and Disneyland Paris grew due to opening the Frozen new land. Do you think that Disney executives are smart enough to realize that they need new lands and either improved or additional attractions in both FL and CA to increase growth of revenue and profitability? Bob Iger should realize that stock prices will increase, NOT decrease, if he announces plans to improve the FL and CA parks in the near term. Stocks rise and fall with future projections, not just the past quarter results. Maybe Disney needs to smarten up and put money into intellectual talent instead of trying to go cheap. Corporations succeed or fail on management, not things. Smart management means success, poor management leads to failure! I wish Bob Iger would realize that.

Have a nice day.

Alfred

I have never thought that a 5th gate made sense. I think most families think of vacations by the week. Four parks plus water park etc. consumes that week. Will people stay longer overall with a fifth park? Doubt it. Investment in the parks will get people to return at a cheaper investment cost.

All this means to me is hotels, tickets, food etc. all getting another increase. Even the minimum for a Disney wedding went up and includes basically nothing.