During Disney’s most recent Investor Day conference, we got to hear about TONS of new shows and movies coming to Disney+ or theaters in the next few years.

©Disney

And while Disneyland and some of Disney’s other theme parks around the world are currently closed, Disney World and other Disney theme parks are currently open. Taking all of this into account and with news of vaccines already starting to be distributed in the United States, one analyst has upgraded his rating of Disney’s stock.

According to MSN, UBS analyst John Hodulik has upgraded his rating of the Walt Disney Company stock from “neutral” to “buy” in a recently issued report. In the report, Hodulik notes Disney’s streaming success and argues that the Disney theme parks will benefit from the reopening of the economy after the COVID-19 pandemic.

©The Walt Disney Company

A stock upgrade like this typically means that the analyst has become more optimistic about how the stock will perform. In the report, Hodulik also boosted the stock price target from $155 to $200. He predicted that there would be “continued outperformance” with Disney’s streaming business. Hodulik noted, “Disney is positioned to achieve scale similar to industry leader Netflix with 340 million-plus global subs by ’24…while its premium intellectual property creates pricing power and enables the company to spend less per sub on content, driving better economics over time.”

©Disney

Hodulik also estimated that Disney will reach direct-to-consumer revenue of $43 billion in fiscal year 2024, and achieve profitability in fiscal year 2023. Disney previously noted that it would have higher content expense in 2024 than anticipated, but expected Disney+ to be profitable in fiscal year 2024. It seems this analyst is predicting profitability may come slightly sooner than that.

©Disney

In terms of the theme parks, Hodulik said that he expects the theme parks will become a “beneficiary of vaccine availability and pent-up demand for leisure travel in the second half of 2021.” He noted that we will see improved attendance as the vaccine becomes more widely distributed. He also expects that the parks could approach their historical performance and attendance by Fiscal Year 2022, with potentially higher margins long-term given some improvements made during the pandemic.

Cinderella Castle

We’ve got our own thoughts on why the vaccine actually might NOT be the cure that Disney World needs. But, only time will tell how quickly we’ll start to see the impact of vaccine distribution on attendance at the Disney parks.

Click here to see why the vaccine might NOT be the cure Disney World needs.

Hodulik also said that UBS data suggests that attendance at the parks has “ramped to the self-imposed 35 percent ceiling.” Disney increased its capacity to 35% last year, and did note that one holiday weekend was nearly full in terms of its capacity. We saw some big crowds at Disney during the holidays, but the crowd levels have been VERY low recently. We’ve even seen reservations for popular spots have openings.

Spaceship Earth

But, things could certainly change in the future.

We saw Disney stock SOAR last year after the Investor Day conference. On December 11th, the stock value was valued at around $178.16, according to Google Finance. At the moment, the stock is trading at around $172.68. So, while the value has dropped slightly, it still has remained quite high.

Screenshot from Google Finance

Disney is set to hold its next quarterly earnings call in February, where we’ll get updates as to the financial status of the company. We’ll be interested to see what information Disney shares then and how those updates affect its stock value. We’ll keep you updated on all the latest!

Click here to see the 5 BIGGEST news bombs from Disney’s Investor Day!

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

WE KNOW DISNEY.

YOU CAN, TOO.

Oh boy, planning a Disney trip can be quite the adventure, and we totally get it! But fear not, dear friends, we compiled EVERYTHING you need (and the things to avoid!) to plan the ULTIMATE Disney vacation.

Whether you're a rookie or a seasoned pro, our insider tips and tricks will have you exploring the parks like never before. So come along with us, and get planning your most magical vacation ever!

Do you own any Disney stock? Let us know in the comments!

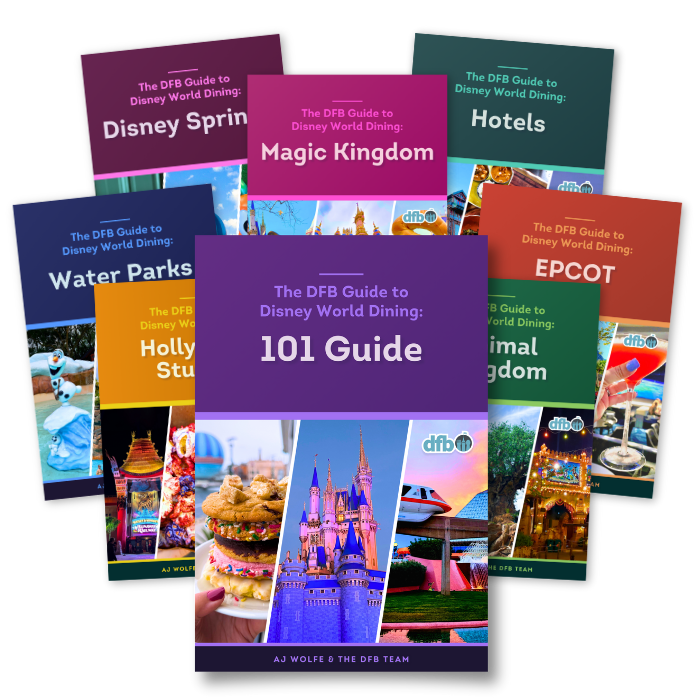

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

TRENDING NOW

Debris from a SpaceX Starship launch could affect flights over Florida.

Let's take a look at our favorite Disney trip essentials hitting the shelves the week...

Disney shared a new clip that provides our first views inside Test Track 3.0.

Come with us to check out Pepe by Jose Andrés at Disney Springs!

If you don't watch out for this reoccurring Disney World hotel issue, you might have...

Take a behind the scenes look at the Pirates Lounge coming to Magic Kingdom!

Disney love hiding things in plain sight in their concept art, so let's dive into...

Disney just dropped MORE details on the Pirates of the Caribbean lounge coming to Magic...

If you're going to drink one drink from each EPCOT pavilion, these are the drinks...

These were our favorite offerings at this year's EPCOT Flower & Garden Festival!

Disneyland just dropped a ton of announcements -- see them all here!

A new Tinker Bell collection just dropped online!

Save big with these Disneyland ticket and hotel offers ahead of Disneyland's 70th anniversary!

Being a Disney Adult certainly has its perks, but what happens when your fellow adults...

Here's a look at all the latest Disney Loungeflys you can score on Amazon right...

All Alice in Wonderland fans need to see these new ears for EPCOT Flower and...

Sure, you may have heard of Disney's Yacht Club, but have you heard of Yacht...

Join us as we try all the citrus-y snacks and sips at The Citrus Blossom...

Check out this new Mickey and Friends Coach Bag!

We love Pop Century Resort, don't get us wrong, but here's why you SHOULDN'T book...