Disney is in a proxy battle with an activist investor who is petitioning for a seat on the Board of Directors. And if that sentence thoroughly confuses you, we’re here to help you sort out exactly what’s going on with Nelson Peltz and Disney.

You’ve likely seen many headlines over the last few days about Nelson Peltz, the Trian Group, and Disney. But who exactly is Nelson Peltz, and why does he care so much about Disney? Here’s a full, simple breakdown of the Peltz-Disney drama.

Who Is Nelson Peltz?

Of course, we need to start with the simple question of who exactly IS Nelson Peltz? Peltz doesn’t work for Disney (that’s what he’s working towards now). He has actually held quite a few positions in the past, many of which were on boards at various companies.

Peltz and the Trian Partners published a website that details their “Case for Change at Disney.” On this site, you can see that Peltz is the CEO and a Founding Partner of Trian. Trian was founded back in November 2005. It’s a “multi-billion dollar investment management firm” that boasts being “a highly engaged shareowner that combines concentrated public equity ownership with operational expertise.”

The group claims to “invest in high quality but undervalued and underperforming public companies and to work collaboratively with management teams and boards to help companies execute operational and strategic initiatives designed to drive long-term sustainable earnings growth for the benefit of all shareholders.” In other words, Trian invests in companies that they think they can help become more efficient and successful.

Trian is considered an activist investor group. According to Reuters, “Activism is a strategy pursued by a relatively small number of firms that essentially bet on a publicly traded company and promise their investors that its share price will rise when their changes are adopted.” Trian collectively owns about 9.4 million common shares of Disney, valued at about $900 million.

Peltz is currently a director of Unilever PLC and Madison Square Garden Sports Corp. He’s served as a director of Janus Henderson Group plc; Invesco Ltd.; The Procter & Gamble Company; Sysco Corporation; Legg Mason, Inc.; Mondelēz International, Inc.; MSG Networks Inc.; Ingersoll-Rand plc; and H. J. Heinz Company. So Peltz has been on a LOT of Boards of Directors in the past.

He’s also been the CEO of Triarc Companies, which owned Arby’s and Snapple at the time. He’s been the CEO of the largest packing company in the world as well.

All of this shows that Peltz has extensive business and investor experience, particularly when it comes to consumer products. Whether or not that particular expertise is right for Disney is currently up for debate.

What Does Peltz Want?

As an activist investor group, Trian’s goal is to convince companies to adopt changes that will increase the value of that company’s shares. The group invests in public companies and then advocates for changes. Nelson Peltz is now focusing on Disney and the changes that he believes will make Disney shares more valuable.

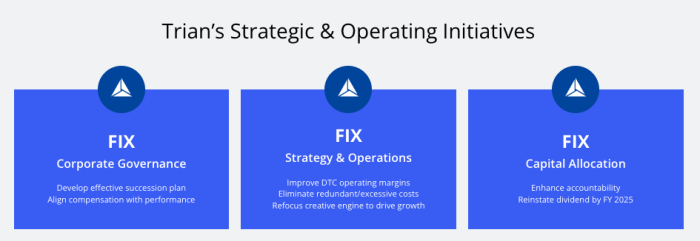

Peltz wants a seat on Disney’s Board of Directors so that he can be more involved in the decisions made at the company. Here’s a quick breakdown of what Peltz wants to fix at Disney:

Peltz says the main problems that Disney is facing right now are CEO succession, poor financial strategy (especially when it comes to streaming), and not enough accountability with capital allocation. Peltz emphasized in a presentation that he feels Disney is over-earning at the theme parks in order to make up for losses in streaming, and he feels this is an irresponsible strategy.

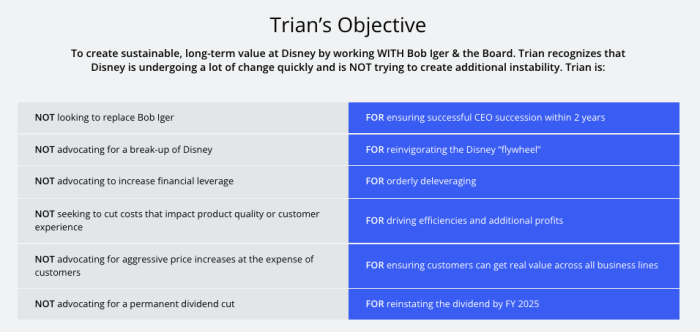

There’s a chart listing more of Peltz’s objectives on the company’s site about Disney:

One of the main arguments that has been leveled against Peltz is that his expertise appears to be in consumer products, whereas Disney’s problems are mainly in the media and streaming category. So could Peltz really provide reliable advice in an area where he doesn’t have much experience? When Peltz was asked about his lack of media experience, he responded, “Have they [Disney’s Board members] shown that they have a lot of media experience? Look at the numbers! […] This is a lot more than a media company.”

Peltz takes particular issue with the company’s acquisition of Fox in 2019. He claims that Disney “materially overpaid” for the Fox assets, which upset the company’s balance books. Many of the current Board members were on the Board when Disney bought Fox.

Peltz’s presentation states that “there are still several current directors and members of management who oversaw and approved some of Disney’s worst corporate governance and strategic failures, including overpaying for the Fox acquisition, the expanding streaming losses, and ‘over-the-top’ compensation packages granted to Bob Iger.”

In short, Peltz sees problems with how Disney is being run, and he believes those issues are affecting the company’s value. He wants to be on the Board in order to correct the problems, particularly those related to CEO succession and streaming.

The Peltz-Disney Relationship

So how does Disney feel about this whole thing? The Board is actively advocating for shareholders to NOT vote for Peltz and instead support other candidates for Board Membership.

In a recent SEC filing, Disney stated that Peltz “didn’t have an understanding of Disney’s business, lacked the skills to drive shareholder value, and presented no strategy.” Disney has also argued that “Peltz has no track record in large cap media or tech, no solutions to offer for the evolving media landscape.” In the same filing, Disney defended the Fox acquisition, stating that it “broadened its intellectual property portfolio further and provided the company with a deep bench of talent.”

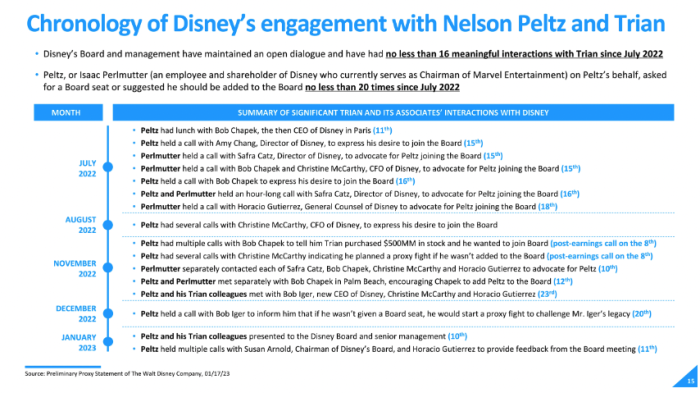

Peltz had a relationship with Disney long before this proxy battle began, though. The Trian Partners’ SEC filing revealed a timeline showing how Peltz has been involved with Disney and the company’s CEOs for several months.

Peltz met with Bob Chapek when Chapek was still Disney’s CEO, and he met with Bob Iger once Iger returned to the position. He was on several calls with the CEOs and other executives at Disney, petitioning for a seat on the board and offering advice about what was happening at the company. The timeline also shows he has spoken with the former chair of the Disney Board — Susan Arnold — recently.

In January 2023, Disney informed Peltz of their decision not to place him on the Board, and they expressed their desire to “find a path for constructive engagement that would avert a proxy contest.” They also offered Peltz the ability to get some non-public information about Disney and meet with “management and the Board quarterly to discuss strategy and other issues so that they could establish some mutual understanding about the Company’s business and strategy.”

Peltz rejected that offer and is now working to win the proxy battle and gain the votes of shareholders so that he can be on the Board and have a vote in Disney’s decisions.

Click here to see the full timeline of the Peltz-Disney drama.

There you have it! That’s the simplified version of what’s happening with Nelson Peltz and Disney. For more information about this situation, check out the following posts:

- Activist Group Believes Disney Has “Lost Its Way” And Pushes for Board Changes

- Disney Pushes Back Against Activist Investor and Defends CEO Bob Iger

- Full Timeline Revealed for Chapek’s Exit, Iger’s Return, and Disney’s Recent Corporate Battles

Stay tuned to DFB for more updates!

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Wow, this guy sounds like just what Disney needs. I have hated over the years seeing Disney let the parks go so they could concentrate on streaming and sports and buy outs. Maybe this guy would bring some sanity. Wish I was a stock holder, I would vote for him.

He sounds terrible for the company and an example of exactly the kind of corporate mentality that holds Disney back

Thanks for covering a controversial topic in an unbiased manner–a rarity nowadays, but certainly needed more often–thank you!