There could be some BIG Disney news on the horizon!

Even though Destination D23 is behind us, there are still opportunities for big Disney announcements coming up. The IAAPA Expo from November 13th through the 17th could provide some Disney Parks updates but there is one important date just before then which could shed some light on future Disney plans.

November 8th will serve as Disney’s Fiscal Full Year and Q4 2023 Earnings Results Webcast. A lot has happened this year with the Walt Disney Company and this investors call could indicate some imminent changes heading into the new fiscal year. We have some speculations as to what Disney might announce.

1 — Updates on the Financial Status of the Parks

It likely won’t be considered a banner year for Disney, especially when it comes to box office returns. With that said, Disney’s profits are on the increase as they pertain to the Disney Parks, Experiences, and Products. We typically see these numbers within the earnings report but it is likely to be discussed during the call.

We’ve covered why Disney was showing some mixed results from its theme park division earlier in the year, and in Quarter 3, once again, Disney had some wins and losses.

Disney Parks, Experiences, and Products revenues for the last quarter increased 13% from around $7.4 billion in July 2022 to $8.3 billion in July 2023. The increase, in large part, is due to better results in non-U.S. Disney Parks. The quarterly report credited major growth at Shanghai Disney Resort and growth, albeit to a lesser extent, at Hong Kong Disneyland Resort. Shanghai Disney was closed last year due to COVID-19, so obviously there was nowhere to go but up. As for Hong Kong Disneyland, results showed more guest spending in high volumes. Prices across the Disney Parks have also increased, resulting in more income.

So where are we seeing some negative trends? Domestically, surprisingly. The U.S.-based parks didn’t perform outstandingly and Disney Vacation Club produced lower unit sales. Disney World struggled more than Disneyland Resort this past quarter, yielding decreasing results. Disney World’s cost of operation went up, and the crowds went down. According to the quarterly report, “The increase in costs was attributable to inflation and accelerated depreciation related to the planned closure of Star Wars: Galactic Starcruiser. Lower volumes were due to decreases in occupied room nights and attendance.”

Disneyland Resort actually produced better returns than the prior-year quarter. The cost of operation at Disneyland rose, but guest attendance and increased spending (mostly due to increased ticket prices) helped offset those costs.

Another Disney boon was the Disney Cruise Line. With fleet expansion and a higher need for increased operating costs, the Disney Cruise Line did well by experiencing a nice boost in passenger cruise days.

So what can we expect? The trends have stayed pretty consistent and the rising prices at both domestic resorts are unlikely to see crowds return quickly enough to change projections dramatically. Therefore, it’s unlikely we learn anything we already weren’t expecting. With that, it could be interesting if there is any indication of worry on behalf of Disney or any indications that changes are coming to the U.S. parks to draw back the consumers.

2 — Streaming Updates

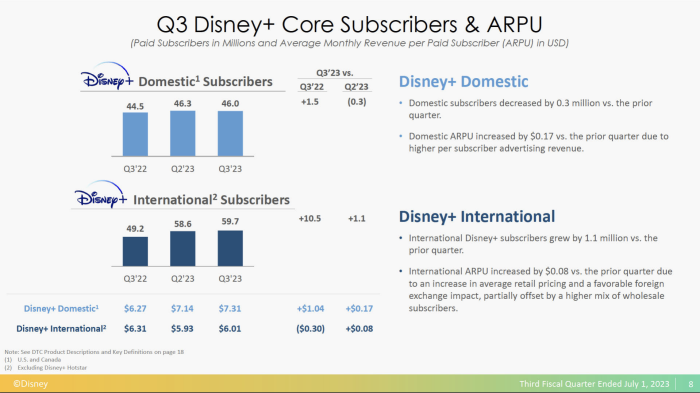

Disney+ is not thriving. Subscribers have been decreasing since Q1 of this fiscal year and Disney+ lost another 11.7 million subscribers in Q3. This trend will surely have investors looking for answers.

Walt Disney Company CEO Bob Iger is aware of the importance of righting the Disney+ ship and said the streaming platform is his “number one priority.” So with that in mind, investors will want to know strides made to win back subscribers in this upcoming earnings call.

During the Q3 2023 earnings call, Iger said Disney’s streaming business is still young when justifying the platform’s struggles but we’re starting to inch into adulthood when it comes to Disney+. Disney reported that “Direct-to-Consumer revenues for the (third) quarter increased 9% to $5.5 billion.” Despite subscriber loss, Disney still cashed in on monthly revenue, with monthly increase “from $7.14 to $7.31 due to higher per-subscriber advertising revenue.”

We had seen subscriber growth until Disney introduced an ad-supported option for Disney+. While roughly 40% of Disney+ subscribers are choosing this option, Disney is looking to increase that number to benefit from the ad revenue. It will be fascinating to see what the trends show now after the mass exodus of Disney+ subscribers.

Some big news recently dropped regarding Disney’s full acquisition of the remaining 33% of Hulu shares from Comcast. In September, Comcast CEO Brian Roberts stated he believed Hulu’s value is more than the $27.5 billion evaluation set five years ago, but that appraisal has not been confirmed. We can expect to hear more from Disney about what the Hulu acquisition will mean for Disney’s streamig business.

Disney’s Fiscal Full Year and Q4 2023 Earnings Results Webcast will begin at 4:30 p.m. ET on Wednesday, November 8th, and can be listened to live by clicking this link. The presentation will also be archived. We’ll be sure to bring you all the big news coming out of this earnings call, so stay tuned for more!

The ONE Announcement That Every Disney Investor Will Be Waiting for on November 8th

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

WE KNOW DISNEY.

YOU CAN, TOO.

Oh boy, planning a Disney trip can be quite the adventure, and we totally get it! But fear not, dear friends, we compiled EVERYTHING you need (and the things to avoid!) to plan the ULTIMATE Disney vacation.

Whether you're a rookie or a seasoned pro, our insider tips and tricks will have you exploring the parks like never before. So come along with us, and get planning your most magical vacation ever!

Are Disney’s revenue numbers encouraging, discouraging, or are you completely indifferent? Let us know!

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Um, Hot Star customer losses are essentially due to non-renewal of cricket rights for India and more or less unrelated to Disney+’s undeniable overall issues. Hot Star was a bolt on to Disney+, acquired as part of the larger Fox transaction. It also has far lower subscription charges than US Disney+, so the loss of the millions of cricket fans isn’t the hit a similar loss of domestic subs would have been.

Keeping “regular” D+ subs up while slashing production of new programming remains a tall order.

>>So where are we seeing some negative trends? Domestically, surprisingly. The U.S.-based parks didn’t perform outstandingly and Disney Vacation Club produced lower unit sales.<<

Somehow, this just isn't that surprising to me.

I recognize the link "prices increased, so revenues increased." But when diehards like ME are thinking "wow, those price hikes are just TOO expensive, simply can't do it anymore", and are starting to seriously contemplate divesting DVC points? There have to be a lot of other folks who are less emotionally-invested in WDW also pulling back due to cost. This last year of price increases has hit hard.

As DVC members, it's depressing to not be able to afford the Annual Pass with no black-out dates.

The Disney business model is very integrated and robust success flows from successful theatrical and new creative releases. When Disney has a big hit, merchandise sales thrive, Disney + does better and kids beg their parents to take them to WDW in the hopes of seeing their new favorite character, live. The Creative side of the business is one area where Disney is really struggling, with the new live-action Snow White likely to be a box office disaster, as an example. Disney would do well to get rid of Iger sooner than later and start with a new senior leadership team. Josh D. should be retained. A new Creative exec is needed, one who will bravely leave the Woke Culture Wars behind.

P AB, we are a DVC family and have been for years. This past October, we went to WDW and stayed on property, first time in a while doing that, and split our time between the Polynesian and the Boardwalk. It was a pseudo test to see if we still loved the Parks like in the old days. We had a blast! Our young adult children also commented that this was the most fun we have had at WDW in years. So no, no desire in our house to sell our DVC membership. We are AP holders and have the Sorcerer’s Pass. It has a few blackout days, but only at times when the parks are insanely busy, and might not be that enjoyable as a result, anyway. The cooler weather in October and the smaller crowds and shorter lines contributed to our great experience. The Castmembers were great, everywhere!

Gigi, why is it that my comment has not been posted? Thanks

Hi Ron. When comments are not approved it is for a number of reasons including, but not limited to insensitivity, inaccuracy, language, rumors, false information, etc. All comments must be linguistically appropriate for a wide audience, and generally not inflammatory or discriminatory in any way. When a comment is left using a national tragedy as the basis for comparing Disney discounts, we will not approve it. If you would like to remove that part of the comment, I will be happy to approve the rest of the comment in question. Thanks so much for your understanding.

DVC producing lower unit sales? Because you have to buy in at too many points if you’re going direct. But I still see people buying resale like crazy. And why would you keep adding when demand isn’t even up? That Poly tower makes ZERO sense to me. RR and VGF aren’t even sold out. Then next year they’ll be pushing the cabins as well?!? Marketing/sales isn’t my field but common sense says to me that supply shouldn’t be exceeding demand here! And how about that the amount of guests staying on property (not to mention OFF that you can’t guesstimate) attending the parks daily is really top-heavy compared to say Universal. A fifth gate and new lands are desperately needed. Forget about streaming Bob.

I will Gigi. Thank you. I apologize for my choice of words. Ron K

Our first to Disney World was in 1984 when our daughters were 5 and 7 years old. We all made WONDERFUL MEMORIES during 32 visits to Disney World. Over the years we would laugh and reminisce around the table with happy stories. DISNEY WORLD IS NOT THE SAME TODAY. Our growing family including our Great Grandson were at Disney World in 2022 and 2023. ITS NOT THE SAME. The cost and the inconvenience of the changes made by Disney have made all the wonderful memories FADE AWAY. Disney, ask long time guests like my family and I if they feel the same.

If they would have no restrictions for those of us who live out of state and want to park hop randomly wander to a park and ride what we want . The current set up is so restricted who wants to spend 1800.00 dollars and not be able to pick your days and book your dining in advance. Having to pay for the top headliner rides and no early park options for resort guests. Used to be 1 to 2 hours in the morning and 1 or 2 hours in the evening for resort guests. Taking away magical express and Tables in Wonderland etc. Disney is far too expensive for the average family and I have been coming to the parks since 1980. My family used to come every other year for a week to 10 days and plan at least one sit down and 1 character meal per day. I last visited the park in March of 2020 with my adult children. Its not worth it to me to spend money and not be able to go and do wahat we want when we want and hop to another park when we want is very sad