If you’ve followed along with The Walt Disney Company news lately, then you’ve probably caught word of the annual shareholders meeting that will take place on April 3rd, 2023.

The meeting will highlight and discuss Disney’s financial performance as well as the strategic plans the Company has in place to better said performance. Plus, shareholders will have the opportunity to vote for the individuals to make up Disney’s next Board of Directors. By now, you’ve probably heard about Nelson Peltz and his activist investment group: Trian. He’s nominated himself to take a seat on Disney’s Board, has suggested his own plans for the future of Company finances, and will rival two other groups for those seats. Now, one of those groups has spoken up with their own plans for the future of The Walt Disney Company.

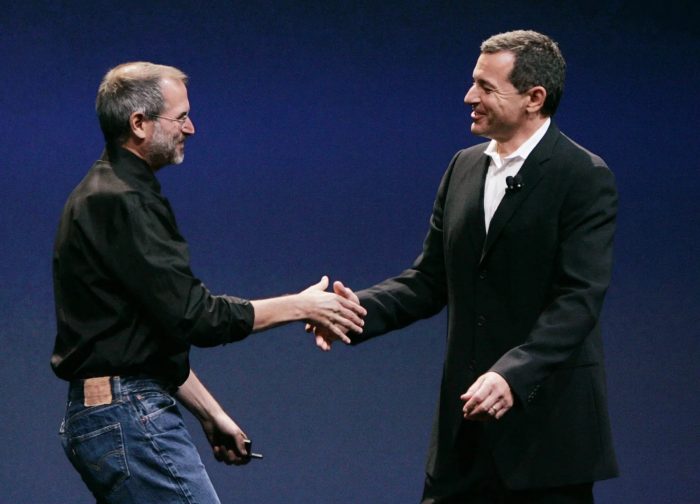

The three main groups aiming for spots on Disney’s Board of Directors include Peltz’s Trian Group, Disney’s recommended group of 12 nominees, and then investment firm Blackwells Capital. While Blackwells does support Disney CEO Bob Iger’s leadership as well as the current Board, they are running for seats on the Board themselves and have some suggestions.

According to Variety, Blackwells officially filed its proxy statement for the 2024 shareholders meeting, and included a letter to Disney shareholders.

Blackwell suggested that Disney could separate its owned real estate, which represents 44 percent of the conglomerate’s market capitalization. The real estate would be separated into independent publicly listed real estate investment trusts, or “a series of investment vehicles in which the shares, cash and/or interests could be distributed to shareholders.”

Blackwells said in the letter, “Disney may simply be too complex for any one successor to Mr. Iger to manage holistically, and Blackwells believes that it is the responsibility of the board to oversee these types of analyses in the ordinary course.”

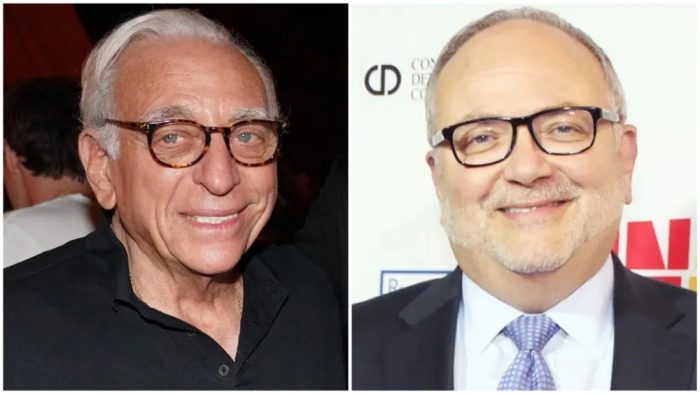

This follows Peltz’s suggestion to focus on streaming (Bob Iger’s priority) and to combine ESPN+ with Netflix to become a preeminent, accessible sports streaming platform. Further, Peltz wishes to essentially upheave the current Board and bring in more “outsiders” so that the Board isn’t strictly made up of Iger and his pals, to put it simply. Peltz nominated himself (many times) as well as former Disney CFO Jay Rasulo for seats on the Board, and has also solicited endorsement from Elon Musk. Iger has had recent battles with Musk after Disney removed all company advertisements from X after Musk left antisemitic comments in a thread.

Regarding this, Blackwells Chief Investment Officer Jason Aintabi said, “Mr. Peltz has requested a seat on Disney’s board no less than 24 times in the last year and half. During that time, Mr. Peltz has not offered a single strategic idea that would benefit shareholders… Begging for board seats is not a strategy that will make any money for shareholders.”

Regarding Musk, Aintabi continued by saying, “[Peltz] seems to focus his efforts on soliciting endorsements from Elon Musk — who doesn’t own a single Disney share, and is aggrieved at Disney for withholding advertising dollars from his struggling social media platform. These are not winning strategies for Disney shareholders.”

We tune in to shareholder calls each year, and we’re intrigued to see what comes of this year’s. We will be the first to let you know of any updates, and will continue monitoring for more statements regarding the Board of Directors and shareholder call in the meantime. Make sure to stay tuned to DFB for more!

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Oh, if ONLY Walt and his brother Roy could return from the grave!!!! The toss-out of all these ANTI-Disney meddlers would be something to see.

I am an active Disney stock holder with a decent investment in the company. While I may not be thrilled with its current value, there are quite a few major growth projects on the horizon. After researching Mr. Peltz’s and Mr. Rasulo’s business acumen, I feel very strongly that neither gentlemen can bring anything positive to the table that would be of benefit for the Disney Company. I will not be voting for either of them.

DFB is giving way too much attention to Mr. Peltz. He or his ideas aren’t worth the time.

I do not see another Michael Eisner/Frank Wells team out there to step in. We need outsiders to come in and ask why not instead of how much..