If you were following Disney news a few weeks and months ago, then you probably watched the company’s proxy battle unfold.

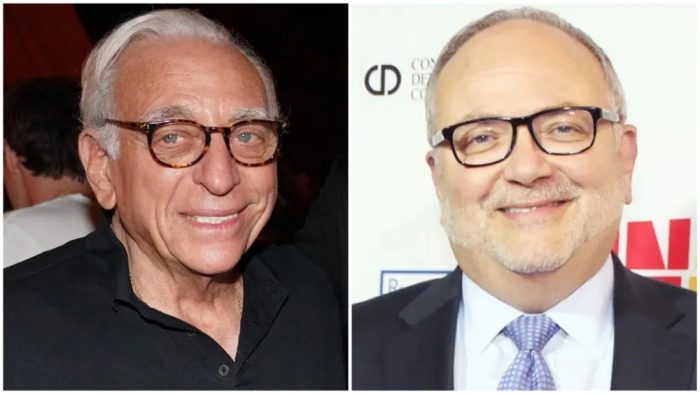

For many months, we watched activist investor Nelson Peltz and his Trian Partners attempt to secure a spot on The Walt Disney Company board. It all culminated in a very important vote during Disney’s annual shareholders meeting, and Peltz ultimately lost the election. But now, we have one major update on the situation.

CNBC reports that Nelson Peltz has sold his entire stake in Disney, according to a person familiar with the matter. All his stock was sold at roughly $120 per share, meaning that he made about $1 billion on the deal.

This move comes just weeks after the shareholder meeting in April where Peltz and former Disney finance chief Jay Rasulo did not earn spots on the board. The 2024 shareholder meeting was not the first time that Peltz had ignited a proxy campaign — he’d taken issue with Disney leadership in the past.

In October of 2023, CNBC reported that Peltz upped his stake in Disney to about 30 million shares, right before kicking off the latest proxy battle. Peltz’s campaign at the time took particular interest in Disney’s streaming woes, as well as the failed succession plan for CEO Bob Iger. Currently, both of those tasks are things that Disney is taking an interest in.

Disney already announced a new sports streaming service to house ESPN content, where the company is partnering with Fox and Warner Bros. And as far as a successor for Bog Iger goes, the candidates have reportedly been narrowed down, and Iger has reassured shareholders that he and the Board of Directors have learned from the past, and hopefully, with this succession, there won’t be so many external factors affecting a successor’s ability to lead the company.

We’ll be interested to see what important business decisions Disney makes going forward, and we’ll keep you in the loop if we get any more updates on policy changes or new business ventures. Stay tuned to DFB.

Click Here to Learn More About the Proxy Battle!

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

WE KNOW DISNEY.

YOU CAN, TOO.

Oh boy, planning a Disney trip can be quite the adventure, and we totally get it! But fear not, dear friends, we compiled EVERYTHING you need (and the things to avoid!) to plan the ULTIMATE Disney vacation.

Whether you're a rookie or a seasoned pro, our insider tips and tricks will have you exploring the parks like never before. So come along with us, and get planning your most magical vacation ever!

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

I hope I never hear of this guy again regarding Disney. Just another Wall Street billionaire who only thinks of his stock price. And don’t give me lectures about shareholders. I’m a shareholder too. I have an IRA. Of course, I want my money to grow, but I’m not greedy about it. There is some morality involved here.

Good! People should buy stock in a company because they believe in the company and want to see it succeed, not for manipulative, agenda-driven, activist reasons. It isn’t fair to the people who run the company, but worse, it hurts the people who work for the company and who are customers of the company. Disney and Iger aren’t perfect, but they have held up well under a barrage of attacks from sources that should be fundamentally about supporting the company.

Why do you call him an activist? If you research his intentions it was to bring the Disney Way back to the forefront. The way things use to be. Kick Iger and his progressive, divisive decisions to the curb, and save the company from boxoffice failures and poor story content.

Why do you call him an activist? If you research his intentions it was to bring the Disney Way back to the forefront. The way things use to be. Kick Iger and his progressive, divisive decisions to the curb, and save the company from boxoffice failures and poor story lines. Sell off that incredible money pit ESPN.